- The Canadian Consumer Price Index is seen gaining ground in March.

- The Bank of Canada sees risks to the inflation outlook as balanced.

- The Canadian dollar falls to five-month lows against the US dollar.

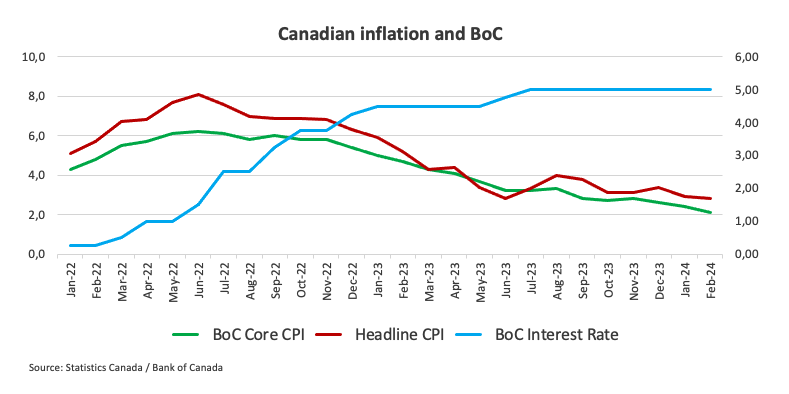

The latest inflation figures in Canada will be published on Tuesday: Statistics Canada will release the Consumer Price Index (CPI) for March. Forecasts point to a 3.1% year-on-year increase in the headline figure, an acceleration from February's 2.8% rise. Monthly forecasts anticipate an increase of 0.7% in the index, compared to 0.3% the previous month.

In addition to the CPI data, the Bank of Canada (BoC) will release its underlying Consumer Price Index, which omits volatile components such as food and energy spending. In February, the BoC core CPI recorded a monthly increase of 0.1% and a year-on-year increase of 2.1%.

These figures will be closely monitored as they may influence the development of the Canadian Dollar (CAD) in the very short term and determine the outlook for the Bank of Canada's monetary policy. As for the Canadian Dollar (CAD), it has shown weakness against the US Dollar (USD) in recent sessions and currently remains near five-month lows significantly above the 1.3700 level.

What to expect from Canada's inflation rate?

Analysts anticipate that price pressures across Canada remained persistent in March. In fact, analysts predict that inflation, as measured by annual changes in the Consumer Price Index, will accelerate to 3.1% from its previous reading of 2.8% annually, mirroring patterns seen in several of the Canada's G10 counterparts, particularly the US. Since August's 4% inflation rate, price growth has generally trended downward, barring a rebound seen in the final month of last year. Overall, inflation indicators continue to exceed the 2% target set by the Bank of Canada.

If upcoming data validates the expected figures, investors could consider the possibility of the central bank maintaining its current restrictive stance for a longer period than initially anticipated. However, a further tightening of monetary conditions seems unlikely, according to statements by bank officials.

Such a scenario would require a sudden and sustained rebound in price pressures and a rapid increase in consumer demand, both of which appear unlikely in the foreseeable future.

During the press conference after the last BoC meeting, Governor Tiff Macklem noted that Gas prices tend to fluctuate, so they are paying close attention to underlying inflation. Macklem stated that the bank has not yet had the opportunity to thoroughly examine the latest US inflation data, although it did not see any significant effects of inflation imported directly from the US. In addition, the BoC stated its intention to monitor whether this downward trend continues and is especially attentive to the evolution of underlying inflation. The bank also noted that house price growth remains significantly high and expects headline inflation to be around 3% during the first half of 2024, decline below 2.5% in the second half of 2024 and reach the 2% target by 2025.

Analysts at TD Securities say: “We expect headline CPI to rebound 0.2 percentage points to 3.0% YoY in March, with prices up 0.7% MoM, supported by another big rise in the energy component. , along with a partial rebound in the prices of food and basic goods after their weak performance in January/February. The analysts added: “The expected rise in headline CPI and the larger month-on-month rise in underlying prices contrasts with the Bank of Canada's desire for more evidence that recent gains will be sustained. Although the bank will have April's CPI report in hand for his next policy decision, we don't think he has enough evidence of a sustained slowdown until July.”

When will Canada CPI be released and how could it affect USD/CAD?

On Tuesday at 12:30 GMT, Canada will release the Consumer Price Index for March. The possible reaction of the Canadian dollar depends on changes in the Bank of Canada's monetary policy expectations. However, barring significant surprises in one direction or another, the BoC is unlikely to modify its current cautious stance on monetary policy, aligning itself with the approaches of other central banks such as the Federal Reserve (Fed).

USD/CAD has entered the new year with a decent uptrend, although this trend appears to have picked up additional pace since last week, well above the 1.3700 figure, a zone last traded in mid-November 2023 .

According to FXStreet Senior Analyst Pablo Piovano, USD/CAD is very likely to maintain its positive bias as long as it stays above the crucial 200-day SMA at 1.3515. Bullish sentiment now faces the immediate hurdle of 1.3800. Conversely, breaking the 200-day SMA could lead to additional losses and a possible decline to the January 31 low at 1.3358. Beyond this point, notable support levels are scarce until the December 20 low of 1.3177, recorded on December 27.

Pablo emphasizes that a significant increase in CAD volatility would require unexpected inflation figures. A below-expected CPI could strengthen the case for potential BoC rate cuts in the coming months, further boosting USD/CAD. However, a rebound in the CPI, similar to trends seen in the US, could offer some support to the Canadian dollar, albeit to a limited extent. A higher-than-expected inflation data would increase pressure on the Bank of Canada to keep rates high for an extended period, which could lead to prolonged hardship for many Canadians facing higher interest rates, as highlighted by the Governor of the Bank of Canada, Macklem, in recent weeks.

Economic indicators

Consumer Price Index (annual)

The Consumer Price Index (CPI), published monthly by Statistics Canada, represents changes in prices for Canadian consumers by comparing the cost of a fixed basket of goods and services. The interannual index compares the prices of the reference month with those of the same month of the previous year. Typically, a high reading is considered bullish for the Canadian Dollar (CAD), while a low reading is considered bearish.

More information.

Next post: Tue Apr 16, 2024 12:30

Periodicity: Monthly

Consensus: –

Former: 2.8%

Fountain: Statistics Canada

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.