- The Bank of Canada (BoC) is expected to cut its policy rate to 4.25%.

- The Canadian Dollar started the month on the wrong foot against the US Dollar.

- Overall inflation in Canada fell further in July.

- Swap markets see around 36 basis points of easing this week.

There is widespread expectation that the Bank of Canada (BoC) will lower its policy rate for a third consecutive meeting on September 4. Reflecting previous decisions by the central bank, this move will likely be 25 basis points, taking the benchmark interest rate to 4.25%.

Since the start of the year, the Canadian Dollar (CAD) has been weakening against the US Dollar (USD), pushing USD/CAD to new highs near 1.3950 in early August. Since then, however, the Canadian currency has begun a period of sharp appreciation, dragging the pair around 5 cents lower by the end of the previous month.

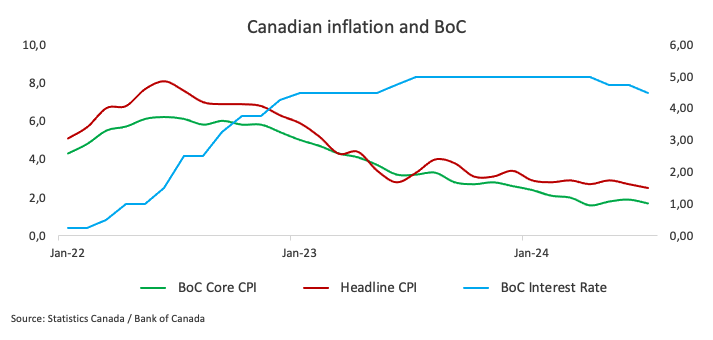

In July, the annual rate of domestic inflation, as measured by the headline Consumer Price Index (CPI), eased further to 2.5% from the same month in 2023, and the BoC’s core CPI fell further below the 2.0% target, recording an increase of 1.7% over the past twelve months. The central bank’s expected rate cut appears to be linked to the continued decline in consumer prices and the anticipated further easing in the Canadian labour market.

Inflation has remained below 3% since January, aligning with the central bank’s forecast for the first half of 2024, with key underlying consumer price metrics also showing a steady decline. Moreover, the BoC is likely to continue to base its future rate decisions on economic data. Current swap markets suggest around 36 basis points of easing in September.

BoC could maintain its dovish narrative

Despite the anticipated rate cut, the central bank’s overall stance is expected to lean to the dovish side, particularly in the context of declining inflation (suggesting that headline CPI could hit the bank’s target at any time) and the increasingly cooling labor market.

Following the rate cut in July, BoC Governor Tiff Macklem argued that the economy is experiencing excess supply, with a cooling labor market contributing to downward pressure on inflation. He explained that his assessment indicates that there is already sufficient excess supply in the economy, and that the necessary conditions are increasingly present to bring inflation back to the 2% target. He also emphasized that rather than needing more excess supply, growth and job creation are needed to begin to pick up in order to absorb the excess supply and achieve a sustainable return to the inflation target.

Macklem added that the central bank is seeking to balance risks on both sides, expressing a determination to bring inflation back to 2% without excessively weakening the economy and causing inflation to fall below target. He noted that these considerations will be carefully weighed going forward, and decisions will be made on a meeting-by-meeting basis.

In light of the BoC’s upcoming interest rate decision, National Bank of Canada’s Taylor Schleich and Warren Lovely said:

“The Bank of Canada is set to lower its overnight interest rate target by 25 basis points on Wednesday, the third such move in as many meetings. The only data point that had the potential to derail a cut — the July CPI report — offered encouraging news on the underlying inflation front, allowing policymakers to ease without controversy.

“Meanwhile, although the July jobs report revealed an unchanged unemployment rate, the labour market outlook remains challenging. Consensus expectations for the unemployment rate (and those implied by the Bank of Canada’s upbeat growth projections) are overly optimistic, and we still see the unemployment rate reaching ~7% by year-end.”

When will the BoC announce its monetary policy decision and how could it affect USD/CAD?

The Bank of Canada will announce its policy decision at 13:45 GMT on Wednesday 4 September, followed by Governor Macklem’s press conference at 14:30 GMT.

Taking any potential surprises out of the equation, the impact on the Canadian currency is expected to come primarily from the bank’s message rather than the interest rate move per se. Taking a dovish approach could result in further support for the CAD and a subsequent decline in the USD/CAD. If the bank signals that it intends to lower interest rates further, the Canadian dollar could suffer and open the door for further gains in the USD/CAD.

According to Pablo Piovano, Senior Analyst at FXStreet.com, “USD/CAD has been on a strong downward path since early August, taking the spot to monthly lows near 1.3640 last week. The bounce since then came mainly on the back of the recovery in the US Dollar (USD), which led the pair to reclaim the 1.3500 barrier and beyond so far.

Paul adds:

“The immediate target emerges at the 200-day SMA, currently at 1.3589. Once this region is cleared, the pair could revisit the 1.3665-1.3680 band, where the intermediate 55-day and 100-day SMAs converge. Further up, there are no notable resistance levels until the 2024 peak at 1.3946 recorded on August 6.

“If the bears regain the initiative, USD/CAD could revisit its August low of 1.3436 (August 28) before the March low of 1.3419 (March 8). A deeper drop beyond the latter exposes a move to the December 2023 low of 1.3177 (December 27),” Pablo concludes.

Economic indicator

BOC interest rate decision

He Bank of Canada The Bank of Canada announces the interbank interest rate. This rate affects a range of interest rates set by commercial banks, building societies and other institutions for their own borrowers and depositors. It also affects exchange rates. If the Bank of Canada is firm on the economy’s inflationary outlook and raises rates, this is bullish for the Canadian dollar, while an outlook for a reduction in inflationary pressures is bearish.

Latest Post:

Wed Jul 24, 2024 1:45 PM

Frequency:

Irregular

Current:

4.5%

Dear:

4.5%

Previous:

4.75%

Fountain:

Bank of Canada

Canadian Dollar FAQs

The key factors determining the Canadian dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of oil, Canada’s main export, the health of its economy, inflation and the trade balance, which is the difference between the value of Canadian exports and its imports. Other factors include market sentiment, i.e. whether investors are betting on riskier assets (risk-on) or looking for safe assets (risk-off), with risk-on being positive for the CAD. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian dollar.

The Bank of Canada (BoC) exerts significant influence over the Canadian dollar by setting the level of interest rates that banks can lend to each other. This influences the level of interest rates for everyone. The BoC’s main objective is to keep inflation between 1% and 3% by adjusting interest rates up or down. Relatively high interest rates are generally positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former being negative for the CAD and the latter being positive for the CAD.

The price of oil is a key factor influencing the value of the Canadian dollar. Oil is Canada’s largest export, so the price of oil tends to have an immediate impact on the value of the CAD. Generally, if the price of oil rises, the CAD rises as well, as aggregate demand for the currency increases. The opposite occurs if the price of oil falls. Higher oil prices also tend to lead to a higher probability of a positive trade balance, which also supports the CAD.

Although inflation has traditionally always been considered a negative factor for a currency, as it reduces the value of money, the opposite has actually occurred in modern times, with the relaxation of cross-border capital controls. Higher inflation typically leads central banks to raise interest rates, which attracts more capital inflows from global investors looking for a lucrative place to store their money. This increases demand for the local currency, which in Canada’s case is the Canadian dollar.

The released macroeconomic data measures the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, manufacturing and services PMIs, employment and consumer confidence surveys can influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment, but it can encourage the Bank of Canada to raise interest rates, which translates into a stronger currency. However, if the economic data is weak, the CAD is likely to fall.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.