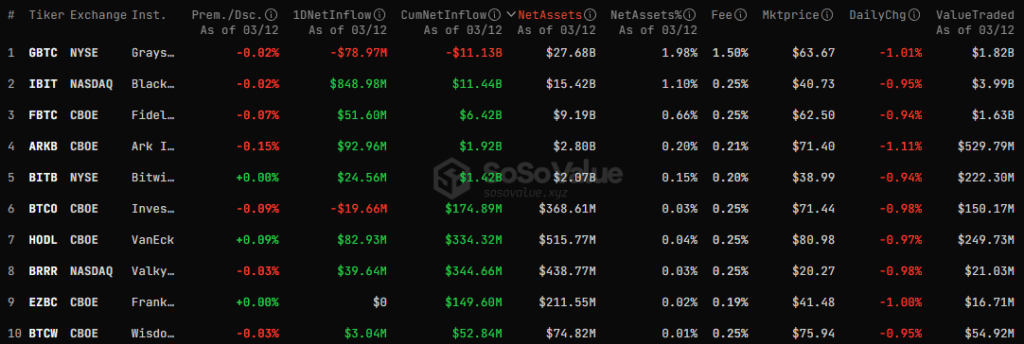

On March 12, 2024, the net daily inflow of funds in the spot Bitcoin ETF sector was $1.05 billion, according to SoSo Value. This is a new all-time high.

This was influenced by two main factors – high activity on the iShares Bitcoin Trust (IBIT) position and a sharply reduced outflow of funds from the Grayscale Bitcoin Trust (GBTC).

Capital inflow/outflow in the spot Bitcoin ETF sector. Source: SoSo Value.

Capital inflow/outflow in the spot Bitcoin ETF sector. Source: SoSo Value.

In addition, IBIT's assets under management (AUM) have exceeded $15 billion. The fund still trails GBTC, but is rapidly closing the gap. At the same time, the net inflow into IBIT exceeded the outflow of capital from the Grayscale Investments product.

According to Bloomberg Intelligence analyst Eric Balchunas, IBIT trading volume on March 12 was twice that of the SPDR Gold Trust:

Second biggest volume day for the ten and best day in the past five w/ $8.5b (only five stocks traded more). $IBIT went crazy again (double $GLD volume) but the middle of pack really seeing pick-up, $HODL and $BTCO did 150m and 250m, huge for them pic.twitter.com/BsGImq1xeq

— Eric Balchunas (@EricBalchunas) March 12, 2024

The total trading volume in the segment amounted to $8.5 billion – the best value in the last five days, the expert emphasized.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.