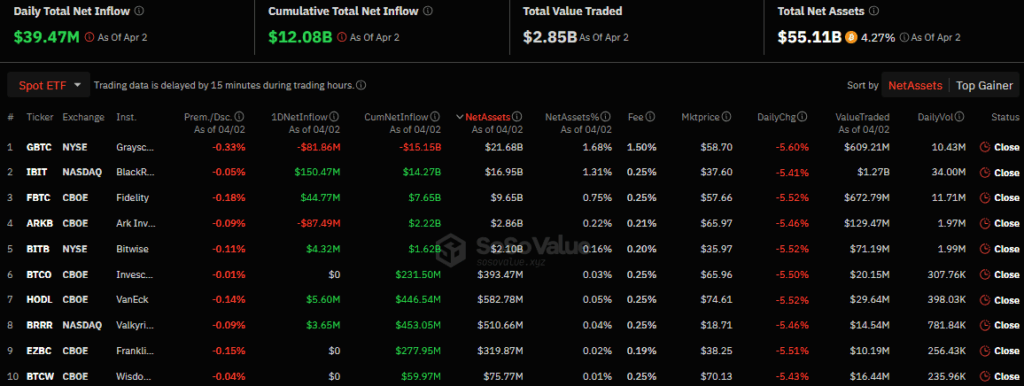

On April 2, 2024, the net daily capital inflow into spot Bitcoin ETFs was $39.47 million, according to SoSo Value. It should be noted that on April 1, an outflow of funds amounting to $85.84 million was recorded, and in the period from March 25 to March 28, $860 million was received by Bitcoin funds.

According to SoSo Value, the first place in capital inflow on April 1 was taken by the iShares Bitcoin Trust (IBIT) crypto fund from BlacRock. It added $150.47 million to its balance sheet, bringing funds under management to $14.27 billion.

In second place is FBTC with $44.77 million, in third is an investment product from VanEck with $5.60 million. The rest of the Bitcoin ETFs received a total of $7.97 million.

It should be noted that an outflow of funds in the amount of $87.49 million was recorded in the ARKB fund from the companies Ark Invest and 21 Shares, this is the second day in a row when a negative indicator is observed. Also, $81.86 million was withdrawn from the GBTC fund from Grayscale Investments.

Earlier, Coinbase analysts said that the digital asset market has recently been fixated on capital inflows into spot Bitcoin ETFs.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.