What is Aerodrome Finance

Aerodrome Finance is a protocol of decentralized finance (Defi), which performs the functions of a decentralized exchange (DEX) and an automated market maker (AMM). This is a relatively young project, which at the end of August will be only two years old. Aerodrome Finance functions on the BASE blockchain – the second -level solution (L2) for the Ethereum network. The ecosystem of the platform provides for two tokens: ERC-20 standard-Aero (utilitarian token), and the ERC-721 standard in the form of NFT-Veaero (control tokens):

Source:

Aerodrome.finance

The total Aero issue is 500 million. Veaero can be obtained through Aero blocking: in a proportion of 100 to 100 If the term is four years, and 25 to 100 if the term is one year. Thus, Aerodrome Finance is a standard exchange with its cryptocurrency. But why did she grow strongly in early summer?

Integration with Coinbase

One of the main causes of Aero growth is the launch of decentralized sites on the BASE blockchain in the main application of the centralized exchange (CEX) Coinbase. This expands the capabilities of Aerodrome Finance users, allowing them to increase both trading volumes and potential profit.

Despite the initial euphoria experienced by investors, there are a number of difficulties associated with the organization of a decentralized exchange. The most important of them is legal. Aerodrome Finance is based on a decentralized autonomous organization (DAO), which the platform does not intend to leave. This will lead to the fact that you will have to adapt to the legal subtleties of specific jurisdictions that put forward their requirements To sites in a similar way.

The growth of network indicators

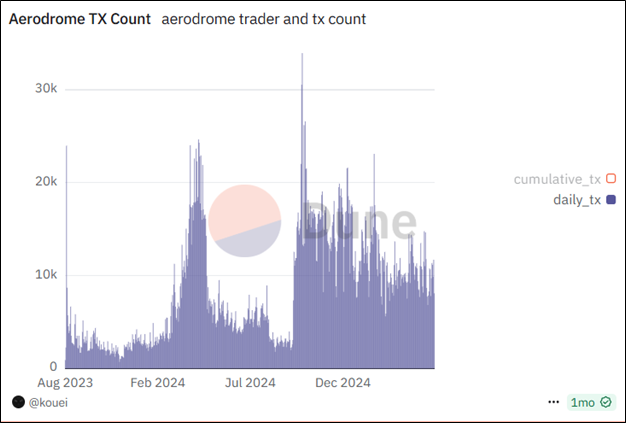

Another reason for increasing the cost of Aero is an increase in interest in cryptocurrency by users. For example, if you take the number of daily transactions for May 2025, then they are stably exceeding 9,000. For comparison, in 2024 this month, the indicator rarely reached this line.

Source: Dune.com

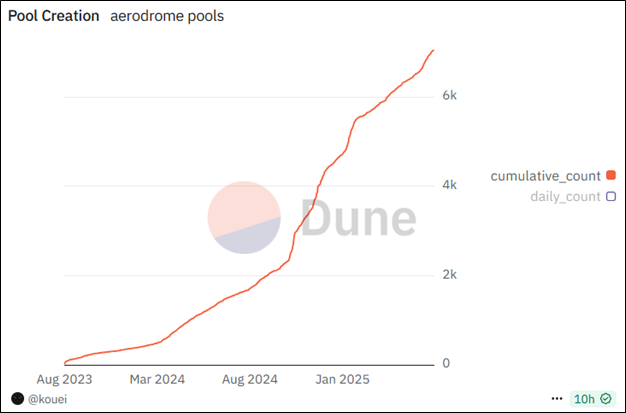

In addition, the number of liquidity pools created significantly over the year. If at the end of June 2024 it amounted to only 1,489, then in 2025 it exceeded 7,000.

Source: Dune.com

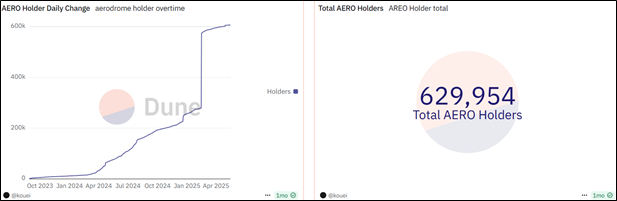

The number of Aero holders reached 629 954. Thus, only in the last 2.5 years the metric has increased almost 2.5 times. If we talk about the indicators of June 2024, then they are exceeded by 5.8 times.

Source: Dune.com

Also on the Base Aerodrome Finance blockchain are the most popular platform. This conclusion can be drawn from trade volumes per day and a month. According to both indicators, Aerodrome Finance takes the first place, bypassing other decentralized platforms that have proven themselves: Uniswap, Pancakeswap and Javsphere.

Source: Defillama.com

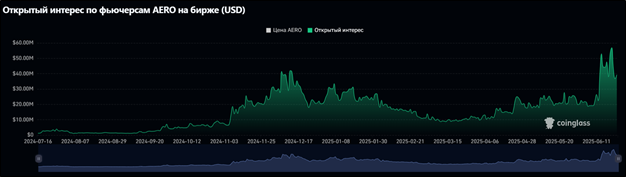

Derivatives market

Derivatives trade indicators have also increased recently. For example, open interest compared to minimums of March 2025 by June 20 increased by five times. On this day, he reached $ 56.93 million in futures, which became the new historical maximum for Aero. On June 23, it is slightly less and amounts to $ 39.29 million.

Source: Coinglass.com

As for the fanding, this indicator from June 21 remains positive. Thus, there is an ascending trend where buyers of indefinite futures are paid to sellers. At the same time, if you look comprehensively for the whole month, then ARO is characterized by quite serious jumps in financing rates, while usually they occur in the minus zone. It also speaks in favor of bulls.

Source: Coinglass.com

The number of short liquidations (forced closure of the positions of traders) from June 12 almost every day exceeds the longing. At the same time, on June 22 and 23 there were significantly smaller than the previous days, which indicates a certain cooling of the market.

Source: Coinglass.com

Technical analysis

Aero is a fairly volatile cryptocurrency. The first quarter of 2025 turned out to be difficult for its holders. From the maximums of December 2024, aero fell a little more than three months by almost 88%. However, since then the situation began to straighten out. By the 20th of June, Aero grew by 165.5%, and after all was almost 30% higher. Correction happened against the background of tension in the Middle Eastern region.

If you touch the indicators of technical analysis, it can be seen that the total trend remains ascending. The price still exceeds a 50-day sliding average. RSI, not reaching the overwhelming area (above 70), began to decline, but still remains higher than the level of 50. For further Aero growth, it is necessary to keep about $ 0.7 above the nearest support level. If this is possible to do this, then it is quite likely to increase to a resistance level of $ 0.8 and even $ 0.96. The first of them remains about 6%, and to the second – 28%. In case of consolidation below $ 0.7, sales may intensify.

Source: TradingView.com

Conclusion

The main reason Aerodrome Finance is the integration of the exchange in the Coinbase application. This caused a new jump in interest in Aero. In addition, strong network and retail indicators provided cryptocurrency support.

This material and information in it is not an individual or other other investment recommendation. The view of the editorial office may not coincide with the opinions of analytical portals and experts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.