The most recent CFTC positioning report for the week that ended on July 1 highlights a significant increase in risk trade. Market participants were actively evaluating the cessation of hostilities mediated by Trump in the Middle East along with greater progress in commercial negotiations between the US and China.

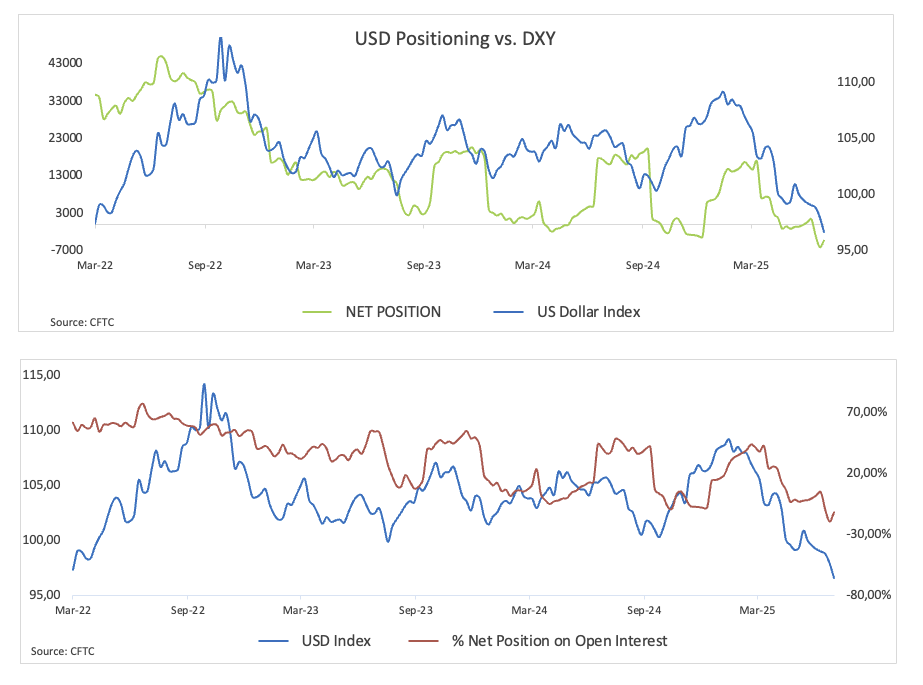

Non -commercial short positions in the US dollar (USD) have fallen to a minimum of two weeks, reaching approximately 4.3k contracts. This decrease occurs together with a fifth consecutive increase in open interest, which has now reached levels not observed since mid -March, around 36.3k contracts. The American dollar index (DXY) continued its downward trajectory, sliding to minimum of several years about 96.40.

The long speculative net positions in the euro (EUR) have experienced a slight decrease, now standing at approximately 107.5k contracts. Commercial players, predominantly coverage funds, have reduced their short net positions to approximately 160.6k contracts, although they remain close to maximum of several months. In addition, the open interest has reached three weeks, exceeding 779K contracts. The EUR/USD has continued its strong recovery, breaking the level of 1,1800 for the first time since September 2021.

Non -commercial traders have seen a continuous decrease in the long net positions of Japanese Yen (JPY), with current holdings falling to approximately 127.3k contracts, marking minimums of several months. Commercial players have increased their bearish positions to almost 151k contracts, marking a maximum of three weeks. This change occurs in the middle of a third consecutive fall in open interest, which has now fallen to approximately 314.2k contracts. The continuous drop pressure has led the USD/JPY to a minimum of several weeks around 142.60 during that period.

Speculators have decreased their bullish positions in the sterling pound (GBP), reducing their long net exposure to approximately 31.4k contracts, marking a minimum of six weeks, coinciding with the second consecutive weekly increase in open interest. The intense drop in the dollar has driven the USD/USD to approach 1,3800, a level not seen since October 2021.

Long speculative net positions in gold have increased to almost 202K contracts, reaching a maximum of several weeks as the open interest experienced a resurgence, rising to approximately 437.7k contracts. Gold prices experienced a downward trend, falling at least six weeks about $ 3,245 per Troy ounce, driven by a decrease in the demand for safe refuge.

Long non -commercial net positions in WTI have increased for the fifth consecutive week, reaching maximum of several months about 234.7k contracts. This development occurred together with an increase in open interest, reaching three weeks of approximately 1,990 million contracts. During that period, the traders focused on consolidating the important setback from levels greater than $ 77,00 per barrel to the region of $ 64.00, a pronounced change that followed the cessation of hostilities in the Middle East.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.