Chainalysis analysts noted that the outflow of user funds is often observed during times of trouble in traditional financial markets. Users are worried about the loss of their savings and the possibility of the collapse of centralized sites. Although, usually such an outflow lasts an insignificant period of time.

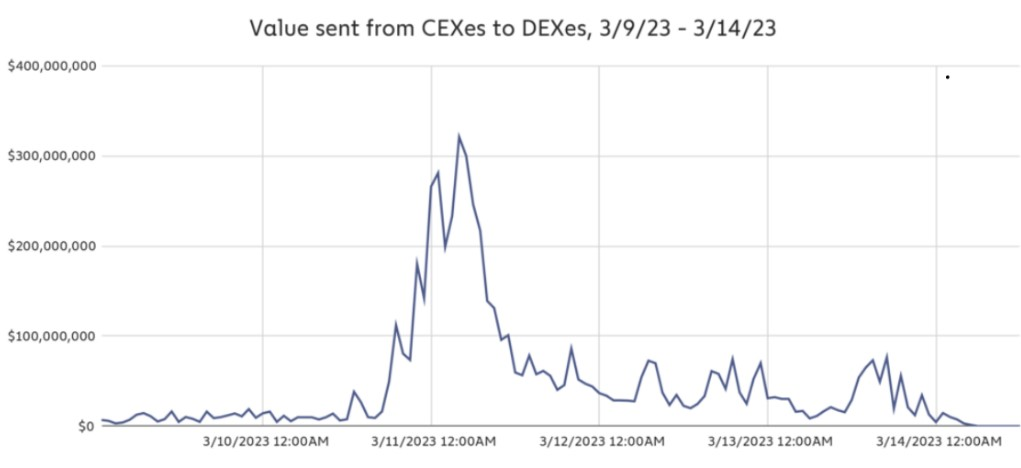

However, after the announcement of the closure of Silicon Valley Bank (SVB) by the California regulator, the volume of transfers from centralized exchanges to decentralized exchanges exceeded $300 million per hour. A few hours later, the indicator fell below $100 million per hour. A similar situation was observed last fall, when the large cryptocurrency exchange FTX went to the bottom.

Against the backdrop of the collapse of SVB, the stablecoin USDC got rid of the dollar. Many users have started transferring their USDC to decentralized exchanges and selling to save money. But, as Chainalysis representatives noted, the demand for the stablecoin remained consistently high.

Analysts believe that this is due to the high level of trust in Circle and USDC – many traders simply wanted to earn and sell stablecoins after the recovery in value. Their plan was a success – USDC restored its peg to the dollar in just a few days.

Recall that after the restoration of the USDC peg to the US dollar, traders began to take profits and the capitalization of the stablecoin fell by $1.74 billion.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.