The growth in the value of cryptocurrencies at the beginning of the year was replaced by a side trend in the second half of January, which should have alerted investors. The beginning of February proved the veracity of the fears.

bitcoin

On February 9, Bitcoin showed its lowest values in 20 days, closing below $22,000. In general, the whole week for the historically first cryptocurrency in the world passed in the red zone: only on Tuesday, BTC was able to add a little more than 2%. In the week of Feb. 3, it fell by almost 7%, from $23,434 to $21,815 on the evening of Friday, Feb. 10.

Source: tradingview.com

The relatively negative news background contributed to the current situation on the market. So, on February 9, it became known about the SEC proceedings with the Kraken exchange. One of the items that the Securities and Exchange Commission is demanding is the cessation of staking activities. Even before that, Coinbase CEO Brian Armstrong argued that staking could be completely banned for retail customers in the United States. And although BTC is based on the PoW consensus algorithm, not PoS (in other words, it is based on mining, not staking), the restrictions of the crypto industry have affected it.

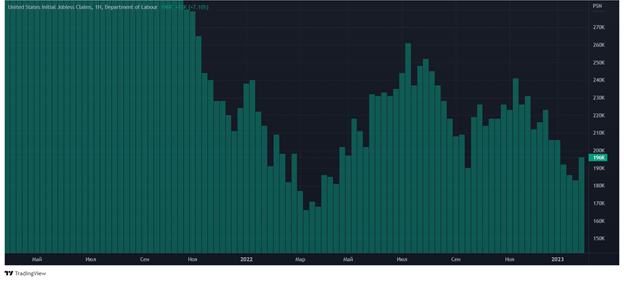

A certain role was played by statistics on the labor market in the United States. She was worse than expected. Fed experts assumed that the number

applications unemployment will be 190,000. In practice, it turned out to be 196,000. This indicator

increased for the first time since December 19, 2022.

Source: tradingview.com

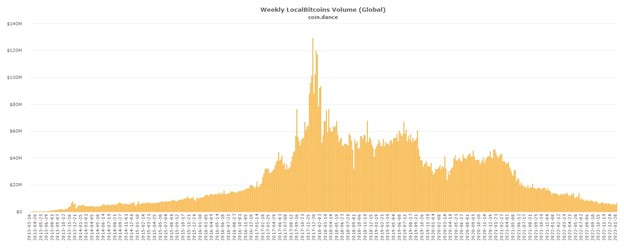

In addition, the market was shocked by the news about the closure of the Finnish P2P platform Local Bitcoins, one of the oldest on the market. The main reason for the cessation of work was the decreased popularity of the crypto exchange, which has been falling since the end of December 2017.

Source: coin dance

In terms of technical analysis, Bitcoin has broken through the $22,781 support level, which should now become resistance. The nearest support level is at the low of January 18, 2023 at $20,358.

Source: tradingview.com

The value of the index of fear and greed has decreased over the week. The indicator is 48, which indicates the neutral sentiment of bitcoin holders.

Ethereum

Ethereum, like bitcoin, has lost about 7% over the past week. Of these, most of them fell on Thursday, February 9, when the coin collapsed immediately by 6.36%. Attempts to break through the resistance level at $1,676.8 and gain a foothold above led to the fact that several times a week the mark was indeed broken.

Source: tradingview.com

The main impact on the ethereum was provided by new legislative initiatives. Otherwise, the signals for ETH were either neutral or positive.

On February 7, the first cases occurred

withdrawals tokens from staking in Ethereum. True, so far on the basis of the Zhejiang test network – the first of three that will precede the Shaghai fork expected in March.

Sberbank this week announced the launch of its own DeFi platform, which will be compatible with the Ethereum network. One of the reasons for such integration in Sberbank was the availability of using MetaMusk wallets. Such cooperation may indicate that major players trust Vitalik Buterin’s platform.

Joseph Lubin (Joseph Lubin) expressed the opinion that it is not possible to recognize the ethereum as a security, since it does not have a centralized apparatus. This point of view is rather ambiguous considering that more than 50% of all staking coins are held by four holders.

Technically, Ethereum is approaching the support level around $1,501.16. The resistance level remains $1,676.8, which no one has been able to successfully storm. Positive investors may add the fact that the 50-day moving average, marked in the chart below in pink, crossed the 200-day moving average, marked in blue, from the bottom up. Thus, a “golden cross” pattern has formed on the chart, which most often signals an uptrend.

Source: tradingview.com

Polygon

Polygon is one of the few coins that continues its upward movement and has not begun to correct. Over the week, the price of the MATIC token rose by 2.8%. True, on February 9, Polygon, like all other cryptocurrencies, did not escape the fall. The entire growth, in fact, occurred on February 10, when the coin added 4.35%. Since the beginning of the year, the price of MATIC has increased by more than 69%.

Source: tradingview.com

Thanks to the results of 2023, the coin is in the top 10 cryptocurrencies by capitalization. By

data CoinMarketCap, Polygon ranks ninth, between Cardano and Dogecoin.

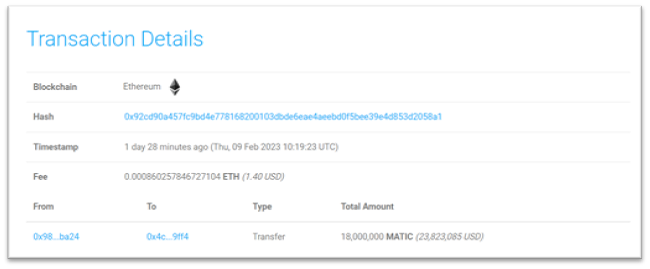

The fact that there are quite a lot of players in the cryptocurrency gives confidence to MATIC holders. February 9 WhaleAlert portal

fixed transfer of 20 million MATIC (about $26.6 million) from one unknown address to another. This transaction is not an isolated example. On the same day, 18 million MATIC was transferred between two other unknown wallets.

Source:

whale-alert.io

In general, Polygon continues to gain momentum, which is reflected in new agreements between the creators of the platform. Many companies agree to cooperate with the NFT platform. Recently it became known that the platform

will cooperate with Doritos chips manufacturer and

Indian media company Shemaroo.

From a technical point of view, Polygon is currently in an uptrend, but, of course, this will end someday. Further growth can be expected if the coin overcomes the $1.3475 level. If the support at $1.20387 fails, then a correction is likely to begin.

Source: tradingview.com

Thus, most cryptocurrencies began to correct during the week after the January rally. One of the few who stay in the bullish trend is Polygon, which recently broke into the top ten in terms of capitalization.

This material and the information in it does not constitute individual or other investment advice. The opinion of the editors may not coincide with the opinions of the author, analytical portals and experts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.