China has announced a major government overhaul that will shake up oversight of its financial system and aim to increase its technological self-sufficiency as a technology war with the United States rages on.

The change in the State Council, the country’s cabinet, is the biggest in years and the third since Chinese leader Xi Jinping took power in 2013.

Tighter control over key departments is said to be helpful in bringing them in line with Xi’s priorities, which range from maintaining social and economic stability to managing rising geopolitical tension with the US.

“These proposed institutional changes reflect the key areas of focus for Chinese policymakers in the coming years, namely improving coordination of financial regulation to enhance financial stability,” Goldman Sachs analysts said on Wednesday.

The Council of State, the government’s top executive body, oversees 26 ministries and dozens of ministerial-level administrative bodies.

Although major decisions are taken by the Communist Party’s Politburo, the State Council exercises some power to implement these policies, especially in economic areas.

Beijing also plans to reduce the size of the so-called “iron rice bowl”, a popular term for jobs with guaranteed security.

The number of civil servant positions in the central government will be reduced by 5% over the next five years.

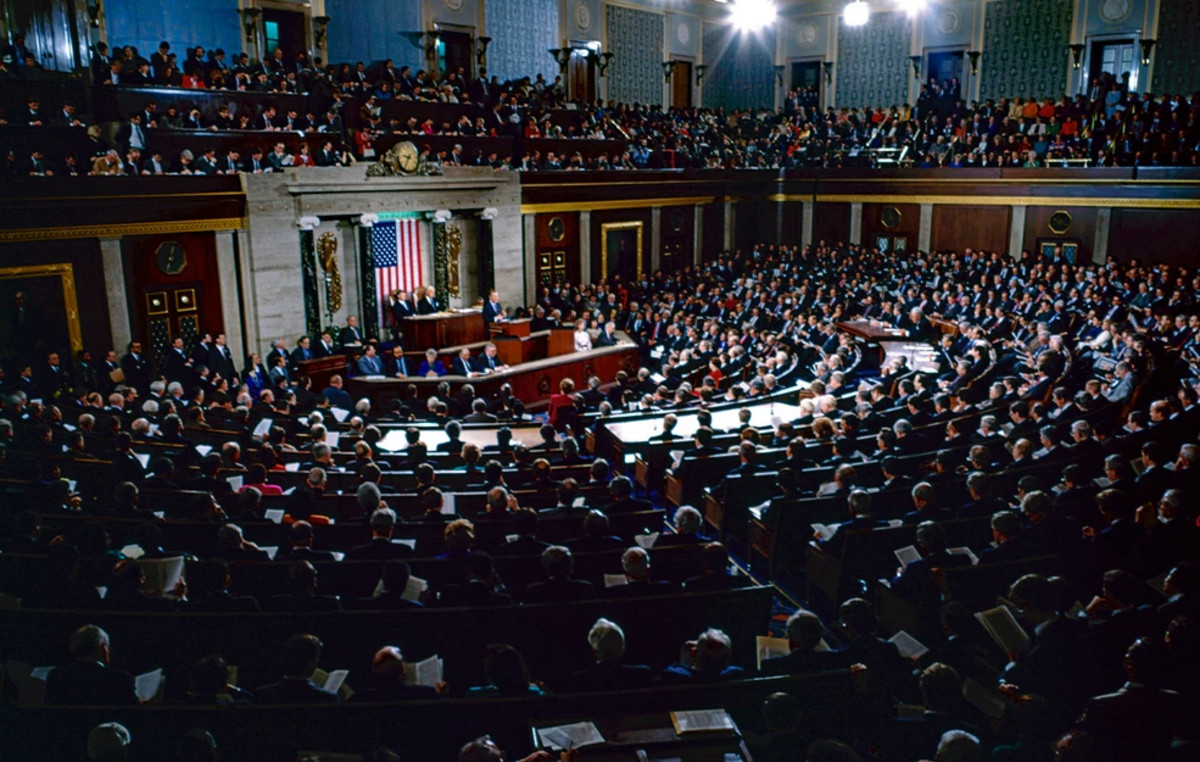

Among the changes announced during the annual meeting of the National People’s Congress, Beijing will establish a powerful new financial regulator: the National Financial Regulatory Administration (NFRA), replacing China Banking and Insurance Regulatory Commission (CBIRC), which oversees commercial banks and insurers.

He will directly manage the country’s top financial holdings, including fintech giant Ant Group, a task that previously belonged to the People’s Bank of China. It will also be responsible for consumer financial protection and investor protection.

Some analysts said Beijing’s apparent move to reassert state control of the economy could spook investors, said Ken Cheung, chief Asian currency strategist at Mizuho Bank.

“Sentiment could deteriorate as investors should remain cautious on any regulatory tightening task, given experiences in the tech sector, real estate markets and the private education sector,” he said.

“It appears that the battles to tighten regulations are not over yet.”

a super regulator

China’s financial system has traditionally been jointly supervised by the People’s Bank of China, CBIRC and China Securities Regulatory Commission (CSRC).

Now, the new NFRA will oversee all financial sectors except the securities sector, which will remain under the CSRC.

It aims to “better manage risks” in the financial system and strengthen oversight of “institutions, behaviors and functions”, says the government proposal. Supervision will be “pervasive”, he added.

“Establishing a super regulator will help improve and expand regulation in the financial and banking sectors, which are becoming more complex and intertwined with other sectors,” said Cheung.

The move comes as risks to the stability of China’s financial system mount amid a housing market slump and economic slowdown.

The real estate sector, which accounts for more than a quarter of total bank lending, is in the midst of its worst recession on record.

Financial stress has already cropped up in a number of areas, from last summer’s protests at rural banks in Henan to widespread mortgage boycotts and rising defaults by property developers.

As part of the review, the CSRC will be upgraded from a “public institution” to a “government institution”.

In addition to its existing responsibilities, it will be assigned a new one to review and approve corporate bond issuance, which is currently under the responsibility of the National Development and Reform Commission.

That move demonstrates Beijing’s “increasing focus on developing the stock market and promoting more direct financing to better allocate capital and help slow the buildup of debt,” Goldman Sachs said.

Achieving technological self-sufficiency

The proposal includes several efforts to boost China’s technology and innovation, while trying to counter increasing US restrictions on the sale of advanced technology to China.

The current Ministry of Science and Technology will be restructured and improved. He will be tasked with promoting a “nationwide system” for innovation, with an increased focus on basic research and the application of technology to existing industries.

“Facing the grim situation of the international technology race and external containment and suppression, [devemos] … better coordinate scientific and technological forces to overcome difficulties in key core technologies and rapidly achieve self-sufficiency in advanced technologies,” the proposal said.

On Monday, Xi lashed out at the United States, while urging China’s private companies to fly alongside the Communist Party and boost growth and technological innovation.

China will also establish a new department to oversee its vast data hoards.

The National Data Bureau will be charged with making data-related regulations and coordinating the sharing and use of data.

“Data … should be increasingly important going forward,” Citi analysts said. “Its use will be placed under [uma] more structured regulation going forward”.

The previous regulatory assault on Big Tech may be over, but industry regulation will be more “normalized”, they said.

Beijing launched a sweeping regulatory crackdown against the country’s internet industry from late 2020 to 2022, aimed at bringing powerful tech companies in line with its priorities.

The Communist Party made it clear before the crackdown began that it needs “politically sensible people” in the private sector, who “will firmly listen to the party and follow the party.”

Source: CNN Brasil

Bruce Belcher is a seasoned author with over 5 years of experience in world news. He writes for online news websites and provides in-depth analysis on the world stock market. Bruce is known for his insightful perspectives and commitment to keeping the public informed.