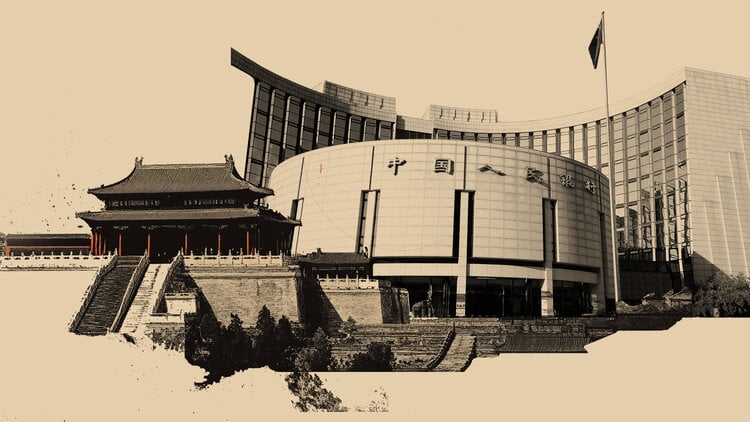

The People’s Bank of China (PBoC) has decided to cut the bank reserve requirement ratio (RRR) by 25 basis points, effective from 5 December.

After the change, the average RRR of financial institutions is around 7.8%, according to a press release recently released by the entity.

This Friday’s decision (25) marks the third cut in the Chinese RRR in 2022. According to the BC, the reduction should release 500 billion yuan in liquidity.

One of the main objectives of cutting bank reserve requirements is to “maintain reasonable and sufficient liquidity”, while the PBoC promises not to “engage in a flood of stimuli” to the economy.

Through the measure, the Chinese BC still hopes to increase support for the real economy, optimize the capital structure of financial institutions and support industries and micro, medium and small companies that were “seriously” impacted by the covid-19 pandemic.

Source: CNN Brasil

A journalist with over 7 years of experience in the news industry, currently working at World Stock Market as an author for the Entertainment section and also contributing to the Economics or finance section on a part-time basis. Has a passion for Entertainment and fashion topics, and has put in a lot of research and effort to provide accurate information to readers.