Analysts by the Citigroup from the Future of Finance division predict the outflow of funds from bank deposits to stablecoins by $ 6.6 trillion. Banking experts compare the situation with the crisis of the 1980s, when the funds of the cash market that have grown from $ 4 billion to $ 235 billion provoked mass closure of deposits.

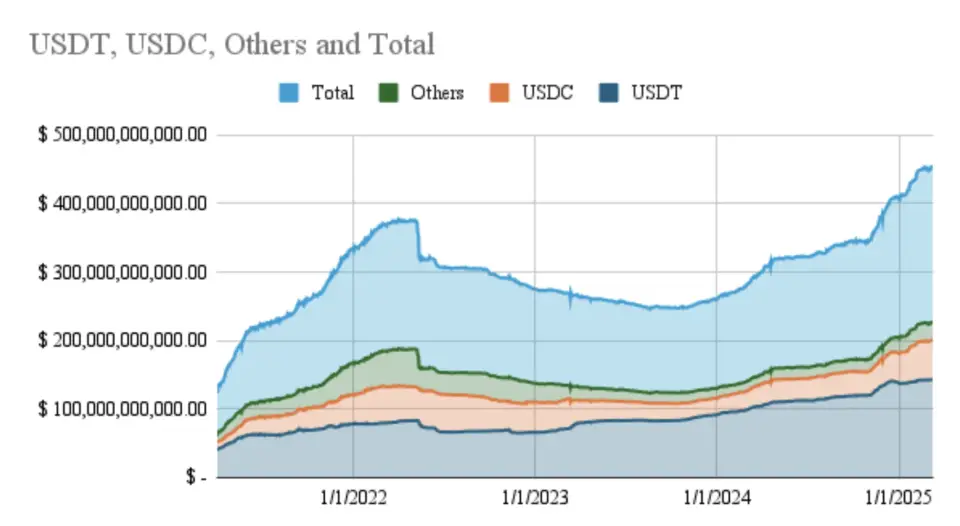

Stablecoins are gaining popularity as a basic asset for quick and cheap payments, overtaking traditional banks in terms of transactions by 13 times, Keyrock and Bitso data say. By 2028, stabilcoins can divert about 10% of the total money supply of the United States, and their annual volume of transactions will reach $ 1 trillion, Citigroup experts calculated.

Citigroup analysts believe that the growth of the popularity of stablecoins can provoke an outflow of liquidity from banks and increase the costs of attracting financing, reducing access to loans and increasing business loans.

Earlier, Citigroup analysts said that by 2030, issuers of dollar stabilcoins could become one of the largest holders of treasury bonds and the US sovereign debt.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.