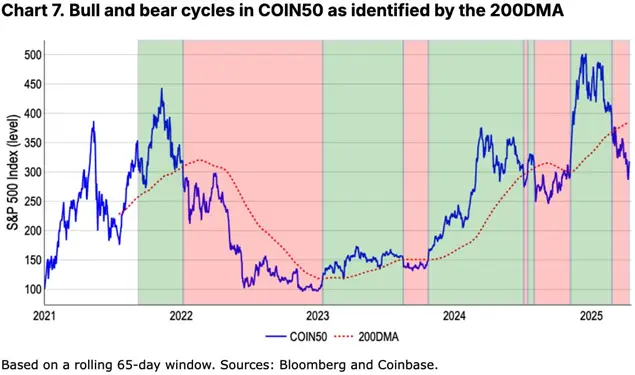

The first cryptocurrency and Coin50 indicator, reflecting the dynamics of the 50 largest capitalization tokens, sank below their 200-day sliding medium. This is the signal of the new bear cycle, said the analysts of the exchange. In Bitcoin, the trend changed at the end of March, at a wider range of assets – in February, experts said.

Coinbase analysts talked about the pressure of macroenvala, in which high -risk assets are faced with growing obstacles in the form of toughening the fiscal and tariff policy of the US authorities.

“Since December, the capitalization of the cryptocurrency rope, excluding bitcoin, has decreased by 41% (from $ 1.6 trillion to $ 950 billion). Venture investments remain 50-60% lower than peaks of 2021–2022. The pressure is especially large in the altcoin segment. Bitcoin has lost less than 20% for the same period and remains more stable against the background of a weak stock market and macroeconomic uncertainty, ”the expert report said.

In their opinion, in the next weeks, investors should take a “defensive position” in anticipation of the formation of the bottom – and remain in this position until the end of June. Most likely, the market will unfold in the direction of increasing bitcoin quotes and other cryptocurrencies by the middle of the third quarter, said in Coinbase.

Previously, Santiment experts Reportedthat the optimism of investors has grown markedly, since they expect in the medium -term perspective to increase the quotes of the first cryptocurrency.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.