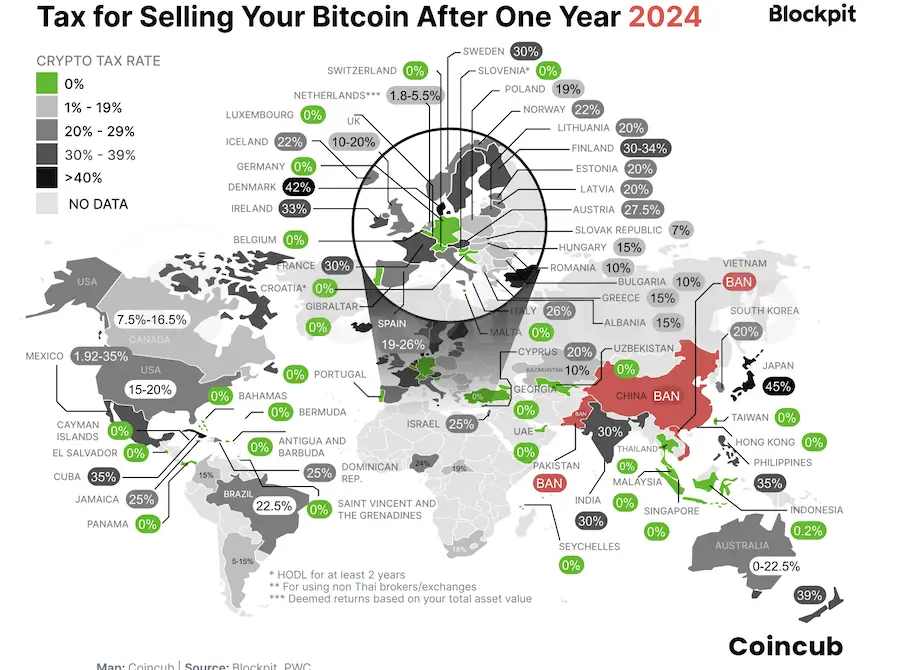

For example, the United Arab Emirates (UAE) and Switzerland lead the list of the most favorable countries for crypto investors due to the absence of basic sales taxes and investments in digital assets. The UAE levies no income tax or capital gains tax on crypto income for individuals, and Switzerland markets itself as a duty-free paradise, offering zero income tax and zero capital gains tax on crypto income.

Coincub experts note that many European countries levy fairly high taxes on income from cryptocurrencies, which reduces their investment attractiveness. In particular, Danish authorities apply one of the highest tax rates for individuals in the world, with up to 53% of long-term and short-term capital gains from cryptocurrencies subject to levies.

Moreover, the Danish Tax Law Council has recommended the adoption of a bill that will allow unrealized profits and losses of Danish crypto investors to be taxed from 2026. At the same time, Eurozone countries are aimed at supporting investors and “offer the most tax incentives for long-term storage of bitcoins.”

Coincub said government regulators’ intent to increase tax revenue by imposing high tax rates could “discourage investment by driving cryptocurrency investments underground or forcing investors to move to more tax-friendly jurisdictions.”

According to a study conducted by analytics company TRM Labs, about 80% of the 21 jurisdictions that have a decisive impact on the crypto industry have tightened their rules for regulating cryptocurrencies.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.