According to the report, 90% of survey participants are geographically located in Europe, Asia, North America, or Africa. 46% have been trading or investing in cryptocurrencies for up to three years, and another 41% have been doing so for four to seven years. The remaining respondents indicated that they were introduced to digital assets more than eight years ago.

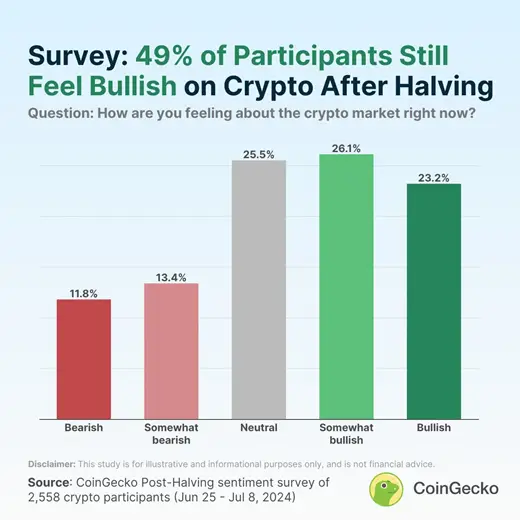

CoinGecko experts stated that 25.2% of survey participants consider a decline in the rate of leading cryptocurrencies to be the most likely scenario, while strong “bearish” sentiments prevail among 11.8% of respondents.

Another 25.5% of traders are neutral and are not taking any active actions in the market, which reflects the uncertainty of participants or indicates that they are waiting to see how the situation will develop in the short term.

CoinGecko analysts believe that of the four categories of participants, long-term investors retained the most optimistic attitude – 54%. But the mood of traders was divided: 39% of respondents expect cryptocurrencies to grow, and 33.5% – a decrease in quotes.

“This indicates that traders with short-term positions tend to adjust their market sentiment in line with price action, while investors are more focused on the longer-term potential of the cryptocurrency market,” the experts said.

The report also mentions the category of “observers” – these are those participants who have recorded their profits and have left the crypto market for now.

Former CEO of the American investment bank Goldman Sachs, co-founder of the investment company Real Vision Group Raoul Pal statedthat the crypto market cap will reach at least $100 trillion in the next ten years.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.