Of the 50 largest airdrops, 23 recorded peak prices for their tokens within the first two weeks of launch. This follows from the new report CoinGecko experts.

In particular, we are talking about the following projects:

- Ethereum Name Service (ENS). The distribution took place in 2021. The estimated value of the tokens at that time was $1.8 billion. The token price increased by 73% by the second day of trading. ATH – $84, trading at $21 at the time of writing, according to TradingView;

- X2Y2. The distribution took place in 2022. 120 million X2Y2 were allocated for it. By the second day, the price of the asset increased by 121%, then quickly rolled back. ATH – $4.3 at the moment. During the preparation of this article, the price of the token dropped to $0.014, according to TradingView;

- Blur. The airdrop took place in 2023 in two stages. The total estimated value of assets is $818 million. During the first distribution, the BLUR rate increased by 90% by the second day of trading. ATH – $8.3 at the moment, when preparing the article – $0.69, according to TradingView;

- LooksRare. The distribution took place in 2022. Estimated value – $712 million. By the 10th day, the asset rate increased by 192%, then rolled back. At the moment, the price of the token reached $7.1, while preparing the article it was trading at $0.08, according to TradingView.

In addition, CoinGecko experts noted some other projects, namely: ArbDoge AI (425% by day 14), Jito (43% by day 2), Wen (37% by day 3), Dymension (75% by day 10), Manta (72% by day 12) and Heroes of Mavia (217% by day 13).

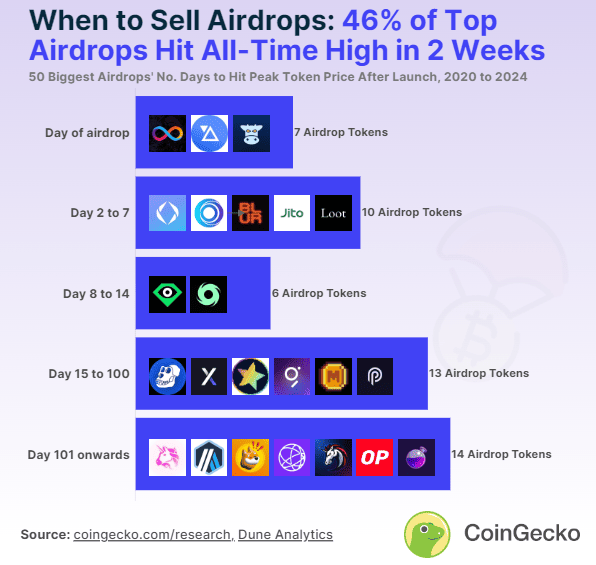

According to the chart below, seven projects peaked on the day of distribution, 10 peaked between two and seven days, six peaked between eight days and two weeks, 13 peaked between 15 and 100 days, and 14 over 100 days.

Peak values of the token rate of projects that carried out airdrops. Source: CoinGecko.

Peak values of the token rate of projects that carried out airdrops. Source: CoinGecko.

19 out of 50 projects recorded ATH on their tokens amid the rally in 2021. CoinGecko experts suggested that in some cases, traders may consider storing tokens from drops for a longer period.

This is also justified for 2024, as the approval of spot Bitcoin ETFs has caused a new round of price growth in the market, the report says.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.