According to CoinMarketCap observations, the rebound of BTC from the level of $72,600 and the drop in the value of the flagship crypto asset within 5% demonstrates a high degree of nervousness among investors reacting to changes in the digital asset market in anticipation of the expected halving of the Bitcoin network.

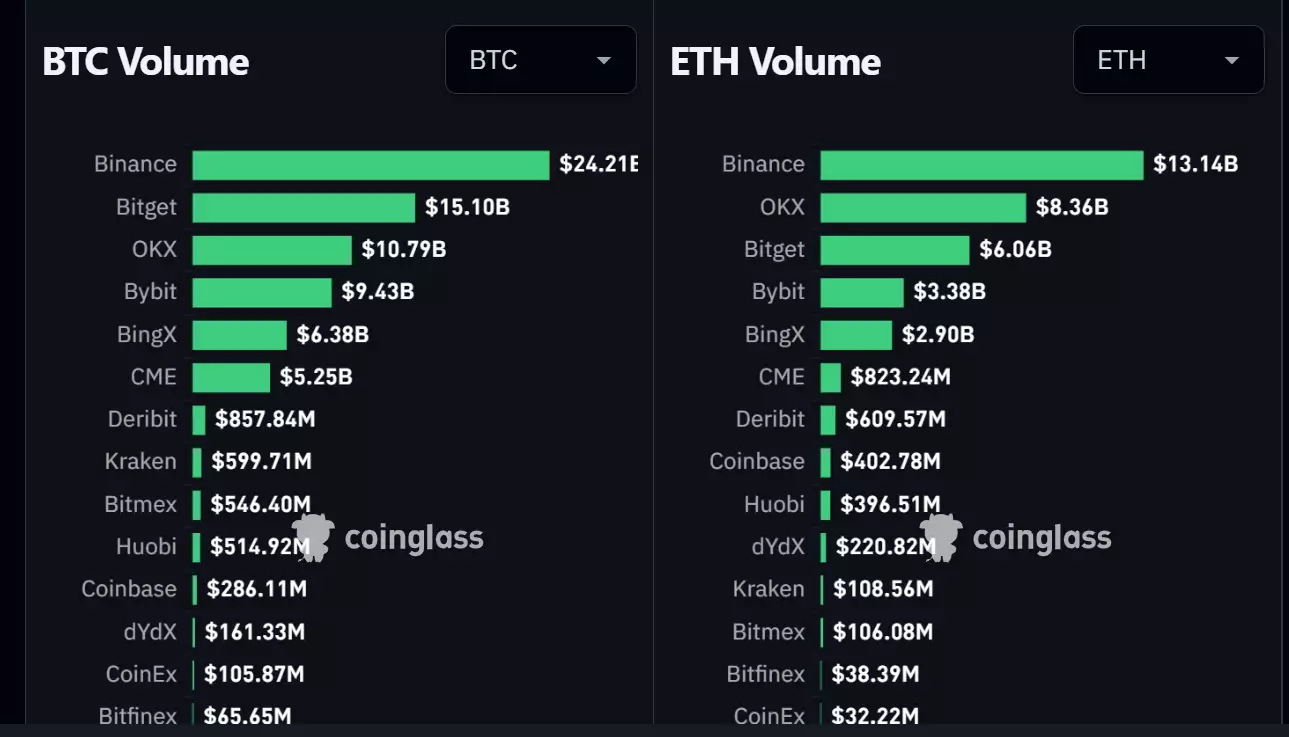

The refusal to storm the historical high and the sideways movement is supported by data on a decrease in the activity of traders and a significant daily outflow of funds from a number of leading Bitcoin ETFs. The overall picture is complemented by data from the CoinGlass observer, demonstrating a high level of per diem sales on large crypto exchanges of the dominant assets: bitcoin and ether.

CoinMarketCap noted that the movement of the Bitcoin rate is naturally cyclical and is adjusted in response to the activity of speculative holders. Such investors are not able to greatly influence the fluctuations of the BTC exchange rate due to the temporary limitation of the circulating supply of Bitcoin before halving. In turn, what is happening allows Bitcoin to maintain the overall return on investment for the majority of long-term holders of the asset and move within the support boundaries of $69,500 – $71,000.

Now the market value of Bitcoin is about $70,700. Over the course of a day, the asset was able to win back part of its lost value within 2.5%.

The day before, Deutsche Bank conducted a survey in which more than 3,600 clients from the USA, Great Britain and the European Union took part. According to the survey results, only 10% of respondents believe that the price of Bitcoin will exceed $75,000 by the end of 2024.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.