The daily drop in the value of large crypto assets varied from 5% to 15%. The maximum decline was demonstrated by the assets of Nervos Network (15%), Dogwifhat (13.5%), Bonk (12%), Bitcoin Cash (11.6%), VeChain (11.4%) and Toncoin (11.3%).

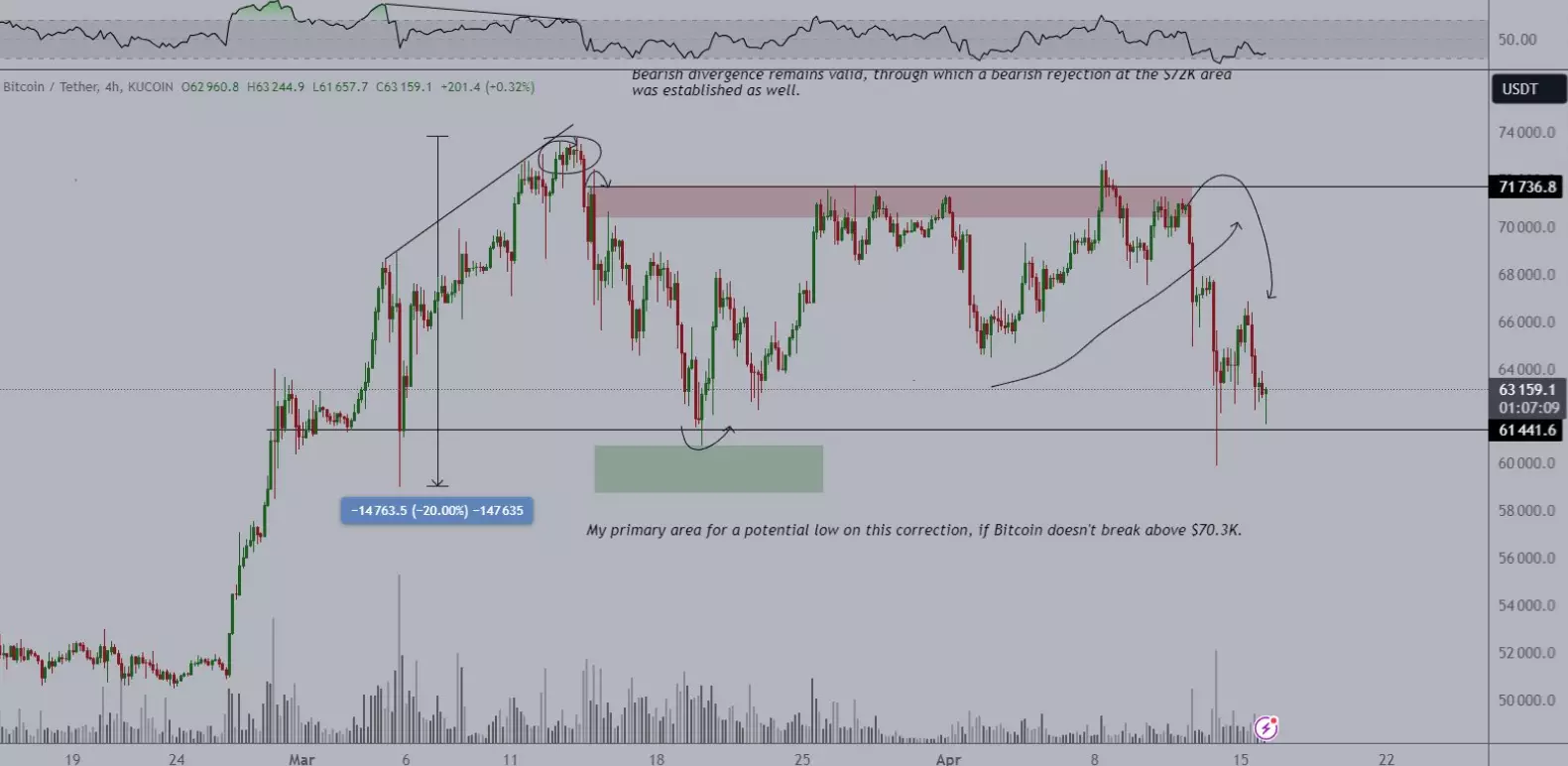

The decrease in the market value of Bitcoin and Ethereum amounted to more than 5%. On the weekly timeframe, the price of Bitcoin fell by 10.4%. Since April 9, the asset has been trading on a downward curve and decreased from $71,671 to $63,270.

Cryptocurrency analyst Michael van de Poppe believesthat if Bitcoin is unable to hold on to the support levels of $60,000 – $61,000, then we will witness an even greater drawdown to $55,000 – $50,000. However, the expert hopes that the price of Bitcoin will most likely hold before the halving its positions at the support level and will soon reach a new historical high.

Over the week, the price of ether fell by 15.2%. Starting from April 9, the asset has also been trading on a downward curve and its value has decreased from $3,169 to $3,085. At that moment, the cost of ETH fell to $2,844.

Due to the increased volatility of the cryptocurrency market over the past 24 hours there have been liquidated

positions of more than 100,000 traders. The total value of liquidated positions amounted to $298 million. Long positions were mainly subject to correction.

Earlier, CryptoQuant CEO Ki Young Ju said that new Bitcoin whales have collected about 9% of the circulating supply of BTC on their balance sheets and continue to increase reserves in anticipation of rising prices. According to the head of CryptoQuant, “bitcoin euphoria” awaits the crypto market in the near future.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.