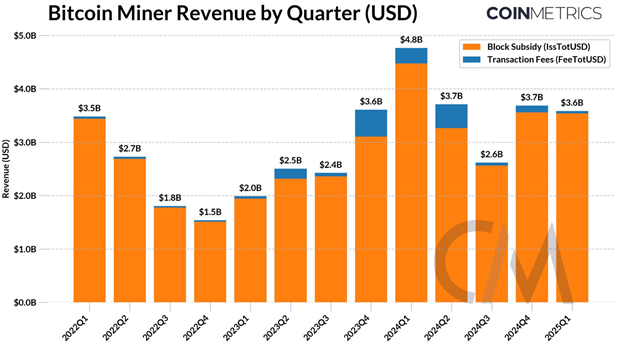

According to analysts, miners were able to survive the period of stabilization after halving in April 2024, adapting to a decrease in remuneration for the block. In a more favorable position, companies that have significant capitalization were. They had the opportunity to switch to more energy -efficient equipment and install it in regions with low electricity tariffs.

“As rewards decreased for blocks, the maintenance of incentives for miners in the long run may require larger transactions and increased competition for space to obtain significant income from network fees,” the report said.

According to experts, the equipment of the Chinese company BITMAIN already provides about 76% of the global hashReite, which increases the risk for devices supply chains.

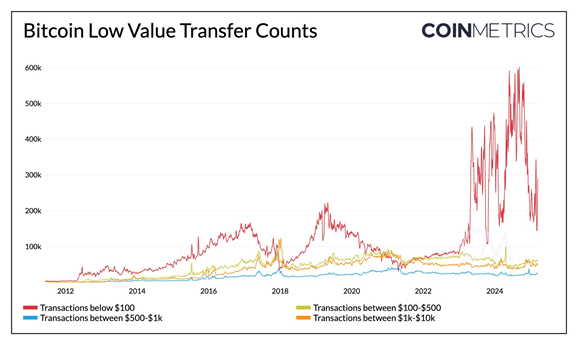

Analysts added that the activity in the transaction sector with a small cost has increased sharply – for operations with sums of less than $ 100 in bitcoins, almost 60% of the total.

Earlier, the experts of the American JPMorgan bank said that public mining companies whose securities are traded on stock exchanges will strive to increase their share in general hashrate of Bitcoin network.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.