Crypto asset management company CoinShares said that despite the purchase of crypto assets at low prices, defeatist sentiment remains in the market.

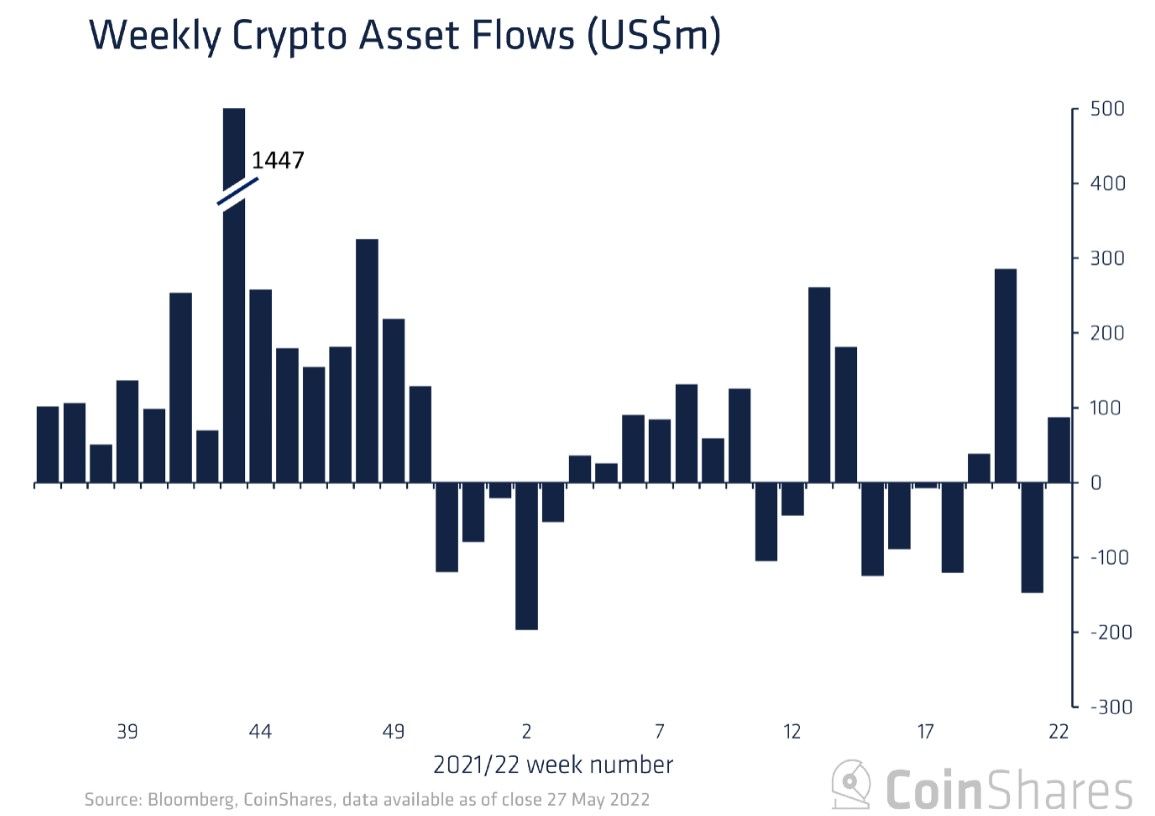

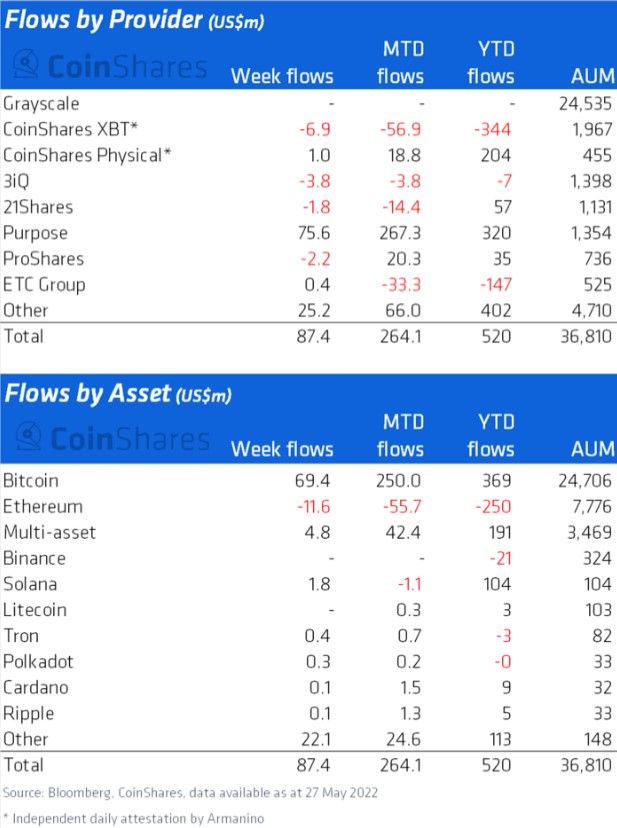

According to the weekly report CoinShares, Cryptocurrency markets experienced a modest $87M capital gain last week, surpassing half a billion US dollars to $0.52B since the start of the year, with US investor inflows rising to $72M and Europeans investing $15.5M in digital assets. million

The influx of money into Bitcoin was $69 million, bringing the figure to $369 million since the beginning of the year. At the same time, the total amount of assets under management is now at its lowest level since July 2021. The report says that last week the influx of short positions in bitcoin amounted to $1.8 million. This confirms once again that the market has not completely got rid of the “bearish” mood.

Ethereum has resumed its decline with $11.6 million in capital outflow last week, bringing the figure to $250 million since the beginning of the year. This is in stark contrast to most other altcoins. Thus, according to CoinShares, the inflow of money into multi-currency products, Solana and Tron amounted to $4.8 million, $1.8 million and $0.4 million, respectively. The DeFi protocol Algorand saw a record influx of funds totaling $20 million last week.

Recently, venture capital investor Tim Draper said that he knows how to fix the situation in the crypto market. According to him, if women around the world start paying with bitcoin for goods in stores, then BTC will easily exceed $250,000, which will positively affect the cryptocurrency market.

Source: Bits

I’m James Harper, a highly experienced and accomplished news writer for World Stock Market. I have been writing in the Politics section of the website for over five years, providing readers with up-to-date and insightful information about current events in politics. My work is widely read and respected by many industry professionals as well as laymen.