Analysts at the investment company CoinShares say that against the backdrop of negative news, the outflow of funds to cryptocurrency funds has decreased, but has not stopped.

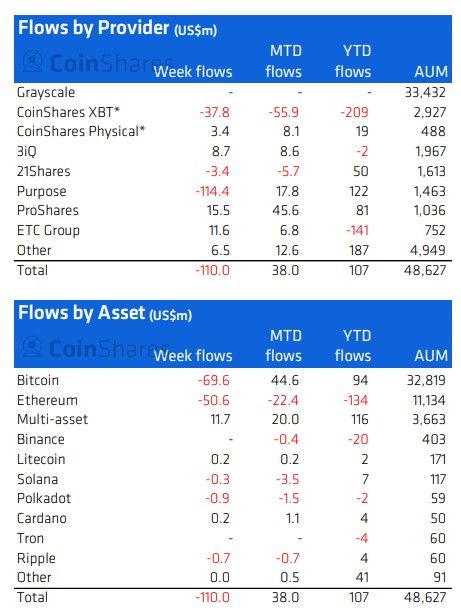

Specialists marked out March 21 report expressing concern over continued capital exodus. At the same time, the authors of the report note that the outflow of money has more than halved, from $110 million to $47 million in a week.

CoinShares analysts put forward a version that the change in the positive trend to negative is primarily due to the tightening of the policy of US regulators. This is evidenced by the losses of American cryptocurrency funds, from which investors were most willing to withdraw money this and last week.

The report says that Joe Biden’s decree to consolidate the efforts of government departments in regulating the crypto industry could be perceived as a negative signal. Bitcoin-based crypto funds lost $32.8 million, $16.6 million were withdrawn from Ethereum funds.

Altcoin-based investment products, on the contrary, received an influx of capital. Litecoin-based funds were the least invested — up to $0.3 million. Polkadot-based funds — $0.8 million — experienced the largest capital inflow. Cardano, Tron, and Binance-based investment products were not very popular among investors this week and retained their previous balance. At the same time, the authors of the report note that for all other altcoins, there was an outflow of funds totaling $0.6 million.

The volume of funds in investment products based on a basket of cryptocurrencies increased by $0.6 million to $3.85 billion. In 2022, they are in demand among investors, the authors of the CoinShares report note.

At the same time, the decline in capital outflow may serve as a positive signal. The founder of the venture capital company Social Capital, Chamath Palihapitiya, believes that against the background of the news of the coming weeks, the cryptocurrency market will show stable growth. According to him, the clarity of the situation in Eastern Europe and the policy of the US Federal Reserve will push Bitcoin up.

Source: Bits

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.