Analysts at CoinShares argue that against the backdrop of a general outflow of money from cryptocurrencies, the LUNA, Fantom and FTT token markets experienced an influx of institutional capital.

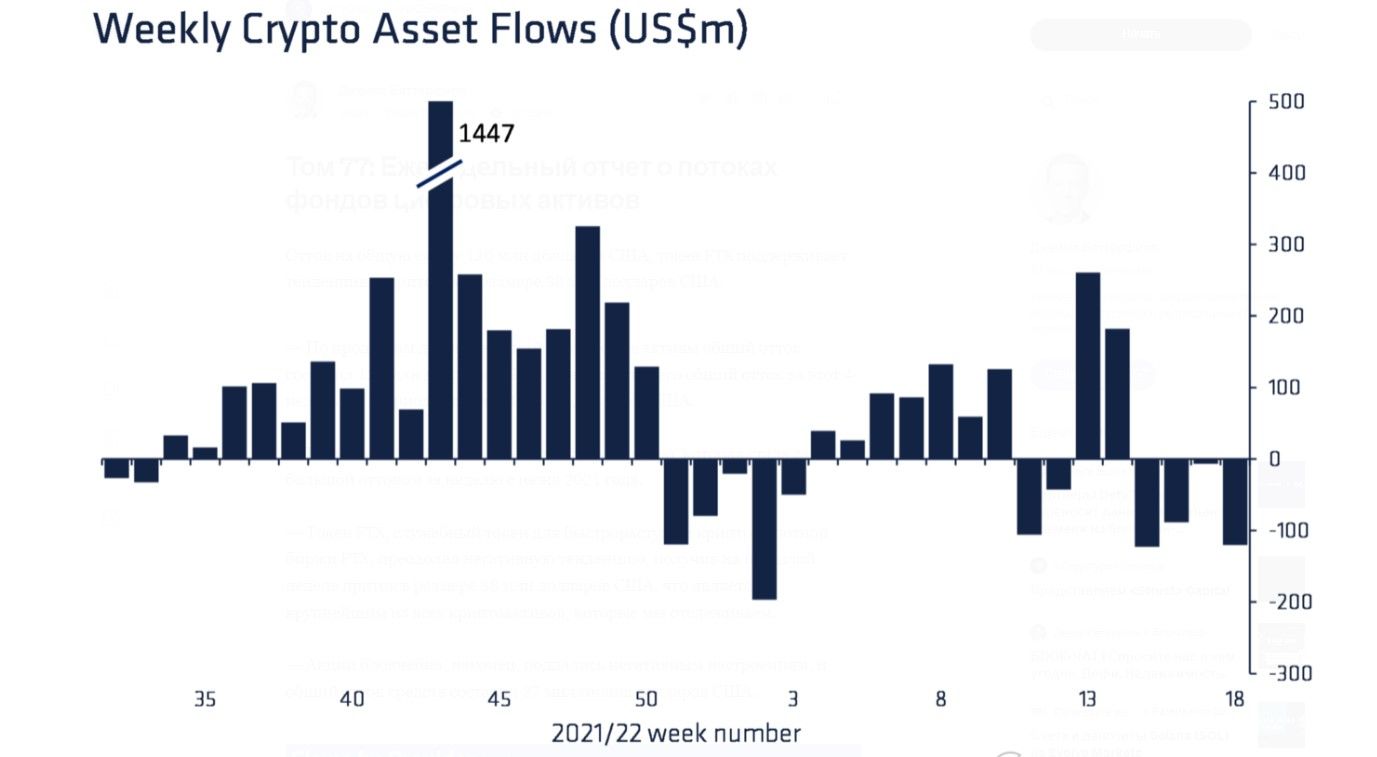

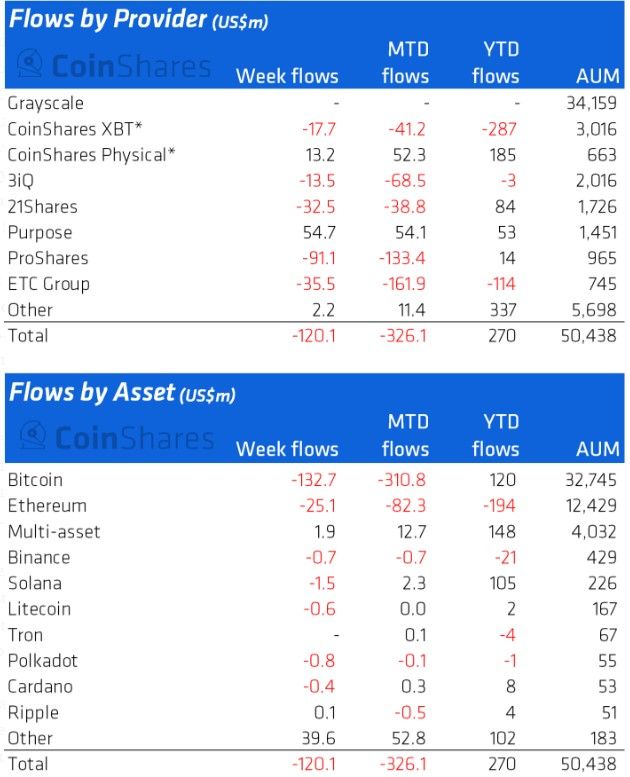

CoinShares published weekly report stating that institutional capital flight from crypto funds continues. Last week, investors withdrew $120 million from crypto funds, bringing the total capital outflow in four weeks to $339 million. Analysts believe that the withdrawal of money does not yet indicate the “bearish trend” that was observed at the beginning of the year. However, they note that the dynamics is very close to the outflow that happened then in the amount of $467 million.

At the regional level, churn was fairly evenly distributed between North and South America, reaching 41% overall, and Europe at 59%. The authors of the report note that over the past week, investors have withdrawn $133 million from the bitcoin market. This is the largest amount of capital that has been withdrawn from BTC since June 2021. The Ethereum market saw an outflow of fiat money totaling $25 million. Analysts say that out of 17 weeks this year, there was an outflow only in five cases. The outflow from the beginning of the year in the Ethereum market is $194 million.

Last week, investors were actively withdrawing capital from most of the major altcoins. At the same time, experts note, there was a slight influx in the Terra and Fantom markets. The inflow amounted to $0.39 million and $0.25 million, respectively. The authors of the report believe that the service token FTT of the FTX cryptocurrency exchange has overcome the negative trend: last week, the inflow to its market amounted to $38 million.

According to experts, last week it was FTT that experienced the largest inflow of capital. The report states that stocks of blockchain companies succumbed to pressure and succumbed to negative sentiment. Last week, the outflow amounted to $27 million since the beginning of the year.

The negative dynamics revealed by CoinShares is quite expected, as the cryptocurrency markets are now in a recession, as investors expect a sharp reaction from the US Federal Reserve to the worst performance of major stock indices since 1971.

Source: Bits

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.