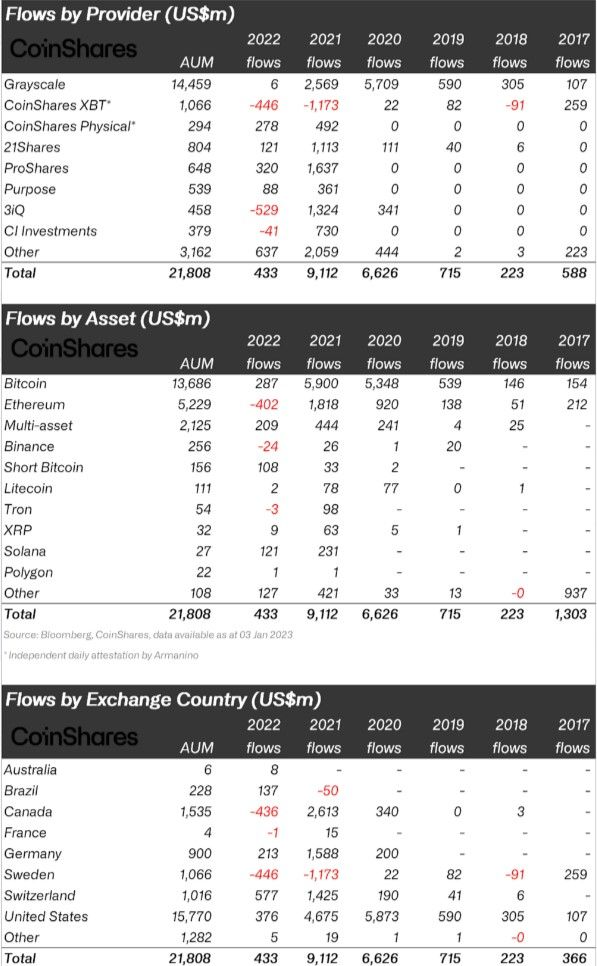

The analytical company CoinShares published a report according to which cryptocurrencies raised only $433 million from institutional investors in 2022. This is the worst figure since 2018.

The report notes that such a significant decline in investment is not surprising – the whole year the cryptocurrency rates fell, there were major industry shocks such as the collapse of the Terra ecosystem and the FTX exchange, and the attitude of regulators became noticeably tougher. Therefore, analysts are still “pleasant” to see the overall inflow of funds.

One of the innovations was the emergence of investment products for short bitcoin – they allow investors to earn when the asset falls. However, such funds have not received much popularity – investments amounted to $108 million, which is about 1.1% of the total volume of funds for the growth of bitcoin.

The most popular products in 2022 were bitcoin and multicurrency funds — the positive balance at the end of the year amounted to $287 million and $209 million, respectively. Ethereum funds continue to have a significant market share – their volume has decreased by $402 million, but still reaches $5.2 billion.

At the end of last year, it was reported that the daily trading volume in the spot cryptocurrency market fell below $10 billion, which has not been this low since December 2020.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.