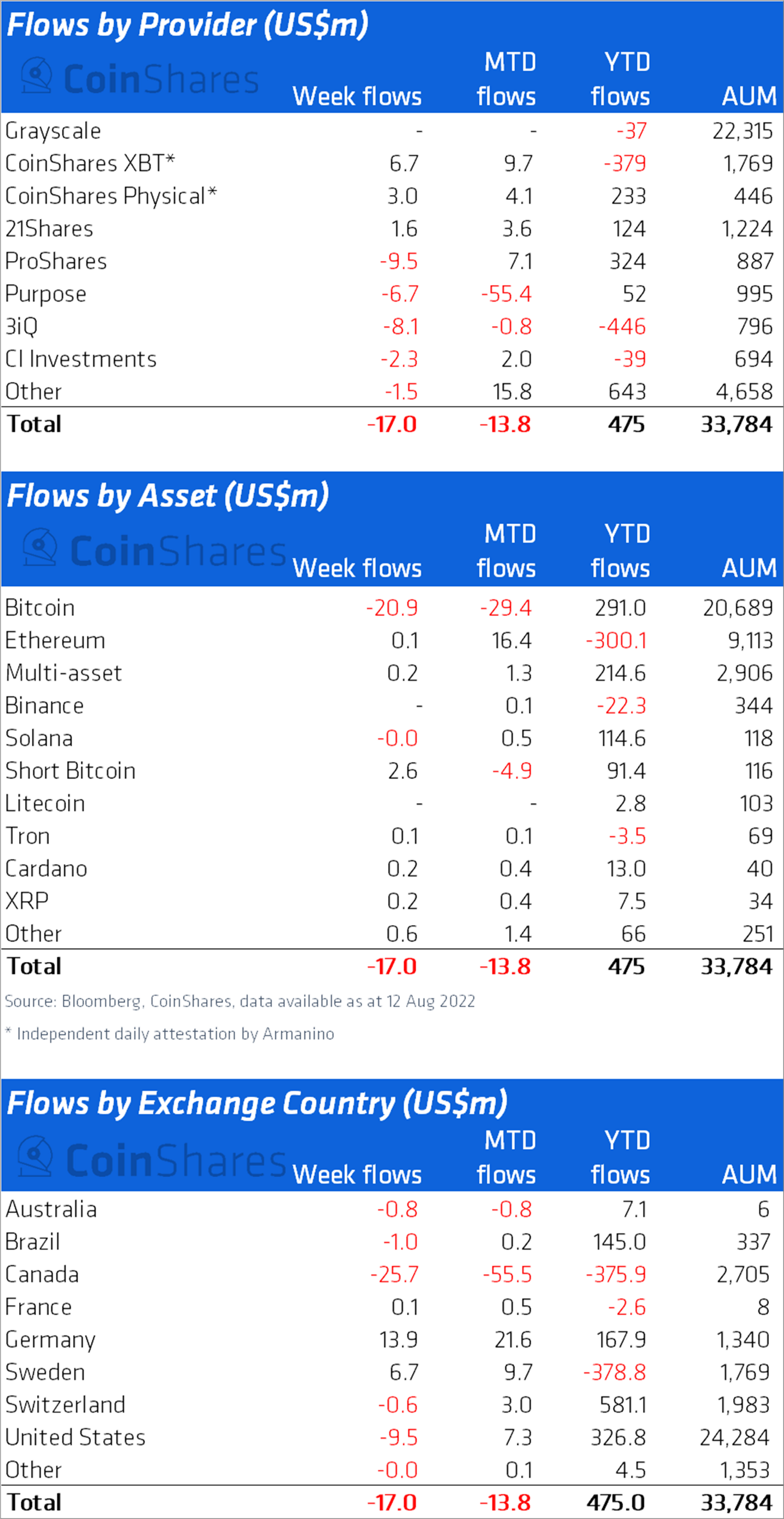

The past week hasn’t been too good for digital asset management companies. According to CoinShares, $17 million was withdrawn from crypto funds last week.

According to CoinShares analysts, institutional investors continue to withdraw funds from Bitcoin products – such funds lost $20.9 million last week. The rest of the products for institutional investors turned out to be in positive territory at the end of the week, with the exception of a slight decrease in the capitalization of funds for the SOL coin. However, the inflow of funds into altcoin funds was also very modest. Only products for the decline of bitcoin attracted more than $1 million.

Interestingly, the funds were withdrawn by investors from Australia, Brazil, Canada, the USA and Switzerland. At the same time, institutionalists from Germany, Sweden and France, on the contrary, increased investments in cryptocurrency funds. Also, CoinShares employees noted that investors showed a noticeable interest in the shares of cryptocurrency companies last week. In total, they have invested about $8 million in shares of such companies, while the balance sheet has increased by only $15.5 million since the beginning of the year.

Last week, institutional investors also withdrew funds from bitcoin funds – then they transferred most of the withdrawn funds into ETH products.

Source: Bits

I’m James Harper, a highly experienced and accomplished news writer for World Stock Market. I have been writing in the Politics section of the website for over five years, providing readers with up-to-date and insightful information about current events in politics. My work is widely read and respected by many industry professionals as well as laymen.