Analysts at asset management company CoinShares reported that institutional investors invested $274 million in cryptocurrency funds in the week of May 9-13, a record since the beginning of the year.

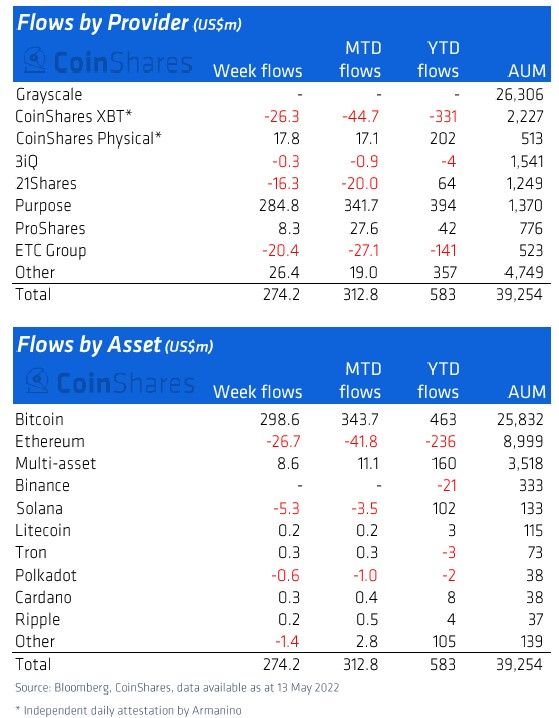

According to report, bitcoin trusts were at the peak of popularity – investors invested $298.6 million in them. But funds were withdrawn from products on ETH, SOL and DOT – the outflow amounted to $26.7 million, $5.3 million and $0.6 million, respectively. Minor investments are fixed in products on LTC, TRX, ADA and XRP. But multicurrency funds received $8.6 million. In general, investors increased investments by $274.2 million over the week.

“It appears that investors saw the decoupling of UST from the US dollar and the subsequent decline in the cryptocurrency market as an opportunity to buy assets,” analysts at CoinShares said.

As for the providers of cryptocurrency products, the bulk of the influx of funds came from the Purpose Bitcoin Futures ETF – $284.8 million. ProShares and CoinShares Physical products also had a positive balance at the end of the week. But CoinShares XBT, 3iQ, 21Shares and ETC Group lost some of their funds.

Earlier, analysts at the Korean company CryptoQuant said that market volatility did not stop the accumulation of bitcoins by large investors.

Source: Bits

I’m James Harper, a highly experienced and accomplished news writer for World Stock Market. I have been writing in the Politics section of the website for over five years, providing readers with up-to-date and insightful information about current events in politics. My work is widely read and respected by many industry professionals as well as laymen.