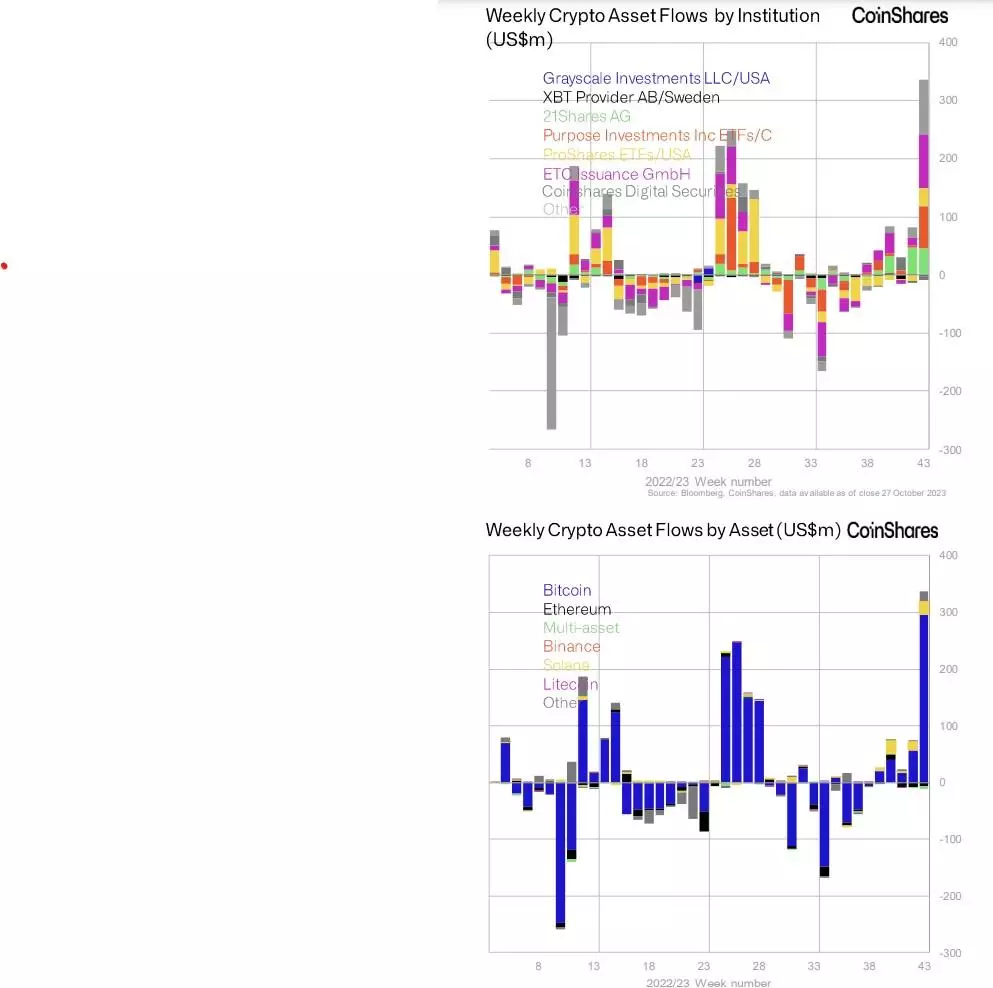

CoinShares analysts attribute the massive increase in interest in investing in cryptocurrency funds to the possible approval of a spot Bitcoin ETF in the United States. It was Bitcoin that became the main beneficiary of the influx of funds – $296 million was invested in products for the first cryptocurrency. The second most popular cryptocurrency was Solana – $23.9 million was invested in funds for this altcoin. This may be due to a recent report from VanEck, according to which the SOL coin could grow by 10,600% by 2023.

It is interesting that investors are betting not only on the growth of Bitcoin, but also on its fall – such products attracted $15.4 million. An outflow of funds was recorded from funds for ether ($6 million) and multi-currency cryptocurrency trusts ($5.2 million).

CoinShares analysts also noted that over the past week, investor activity from the United States was low – only 12% of $326 million came from investors in the world’s largest economy. Representatives of Canada, Germany and Switzerland invested the most funds ($134 million, $82 million and $50 million, respectively). Representatives of the Asian region invested another $28 million. This is the largest influx of funds into cryptocurrency funds from this region in history.

Earlier, analysts at the investment bank JPMorgan warned that the approval of spot Bitcoin ETFs in the United States could occur before January 10.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.