CoinShares has published another weekly report on the state of affairs of cryptocurrency funds. For the first time in five weeks, total fund inflows exceeded outflows.

According to

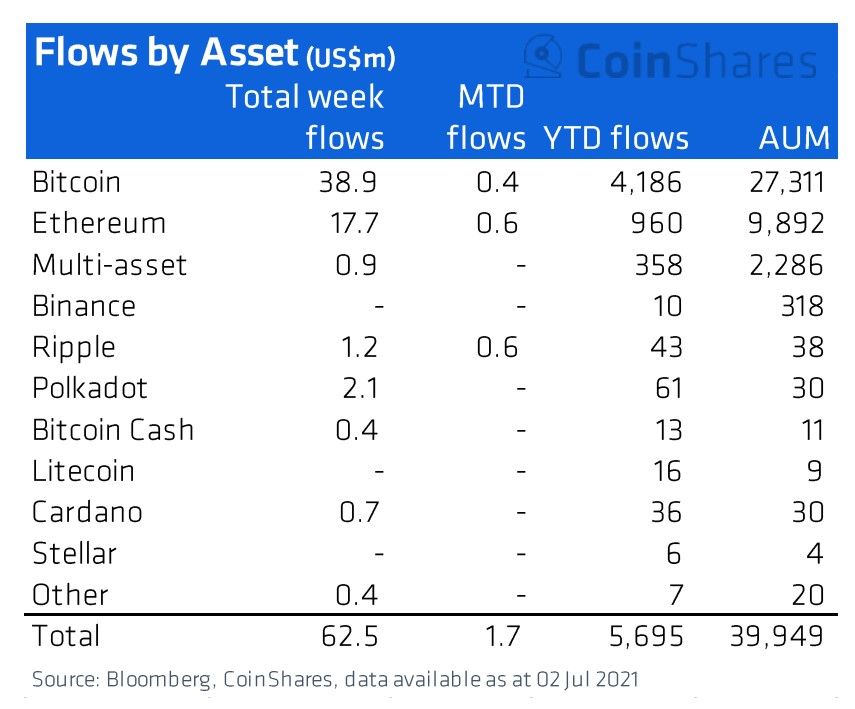

report, the inflow of funds to cryptocurrency funds from June 28 to July 5, 2021 amounted to $ 63 million. This is the first positive result in the last five weeks.

The inflow has been recorded in all digital assets supported by funds, this has not happened in the last 9 weeks. The total volume of assets under the management of cryptocurrency funds was $ 39.95 billion.

“There has been an influx of investment in all digital assets, which signals a shift in investor sentiment,” said James Butterfill, investment strategist at CoinShares.

As usual, most of the purchases fell on bitcoin – institutional investors invested $ 39 million more in the first cryptocurrency than they withdrawn. The inflow of funds to Ethereum amounted to $ 17.7 million.

As for management companies, not all products showed an influx. For example, $ 10.2 million was withdrawn from the products of CoinShares itself, and since the beginning of the year, the company’s funds have lost $ 447 million. The Purpose, ETC Issuance and 21Shares funds showed positive results. Also, an inflow was recorded in the funds of small companies.

Grayscale Investments, the largest cryptocurrency fund management company with more than $ 30 billion in assets, announced a change in the composition of the popular Digital Large Cap Fun (GDLC) trust. Slightly over 4% of the fund’s funds will now be invested in the Cardano cryptocurrency (ADA).

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.