For seven weeks in a row, CoinShares recorded an influx of funds in products for institutional investors, but last week ended the trend.

Analysts of the largest crypto asset management company in Europe reported that North American investors withdrew most of the funds for the latter – $ 80 million. They began withdrawing money from cryptocurrency funds at the beginning of the week. Most likely, this is due to the decree of the American President Biden to carefully study the possibilities and consequences of integrating the cryptocurrency industry into the US economy. European investors withdrew another $30 million, while analysts did not find the reasons for such behavior.

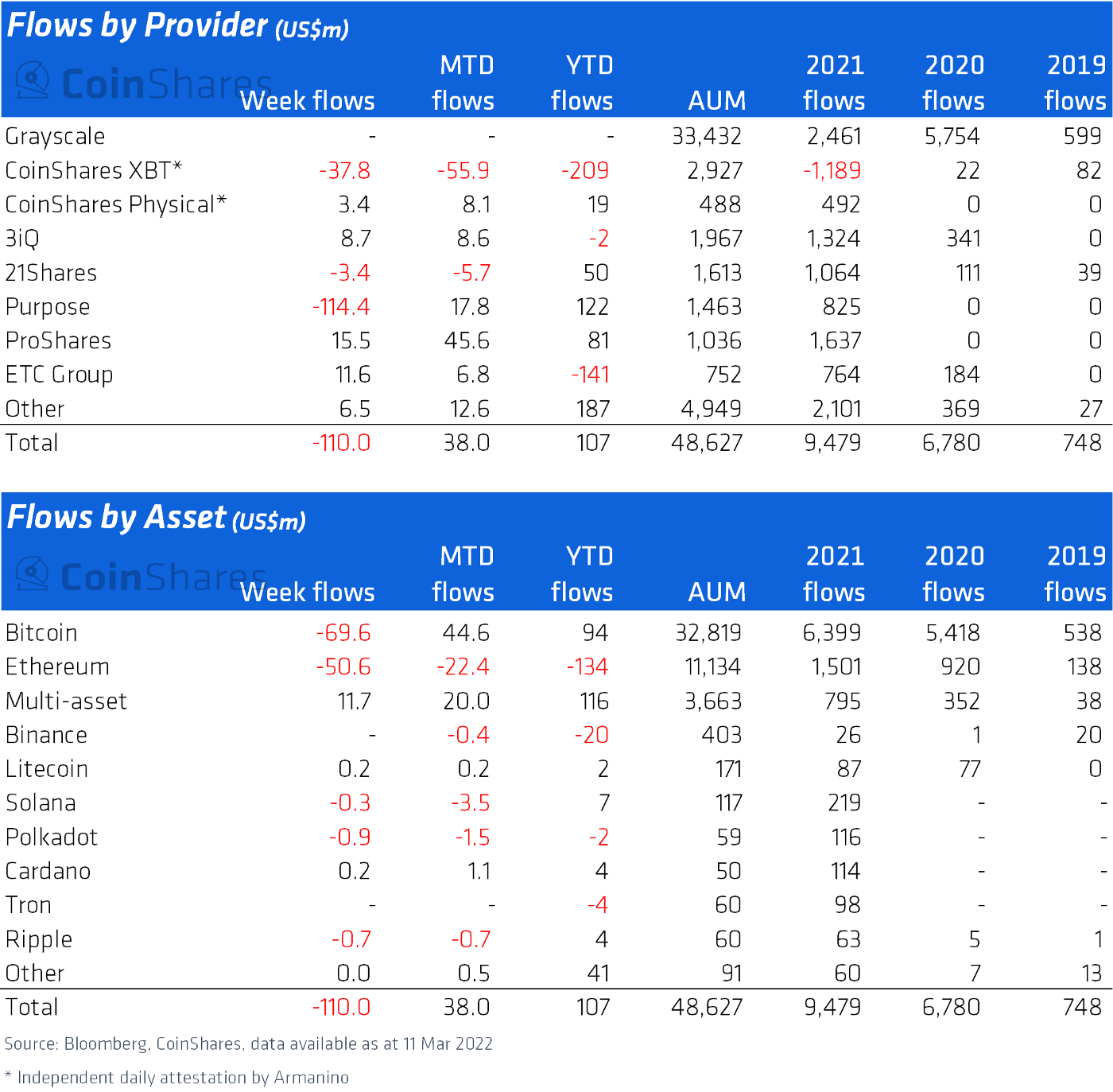

Funds were withdrawn from almost all instruments – bitcoin funds lost $69.6 million, investors withdrew $50.6 million from Ethereum trusts. Investment products for altcoins lost less – funds on Solana, Polkadot and Ripple lost $0.3 million, $0.9 million and $0.7 million, respectively.

Interestingly, investors were attracted by funds investing in several assets at once – the inflow of funds into such products amounted to $11.7 million at once. Also, funds on Litecoin and Cardano recorded a slight positive balance ($0.2 million each).

The structure of the funds suggests that $114.4 million was withdrawn from the products of the Canadian company Purpose, which provides access to cryptocurrency ETFs on the local stock exchange. Also, the outflow was recorded from the CoinShares XBT and 21 Shares products. The rest of the companies reported a positive balance of funds by the end of the week.

Recall that a week earlier, the inflow of funds into cryptocurrency investment products amounted to $127 million.

Source: Bits

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.