CoinShares analysts believe that the growth of interest in the first cryptocurrency is directly related to the distrustful attitude towards US dollars and Ethereum.

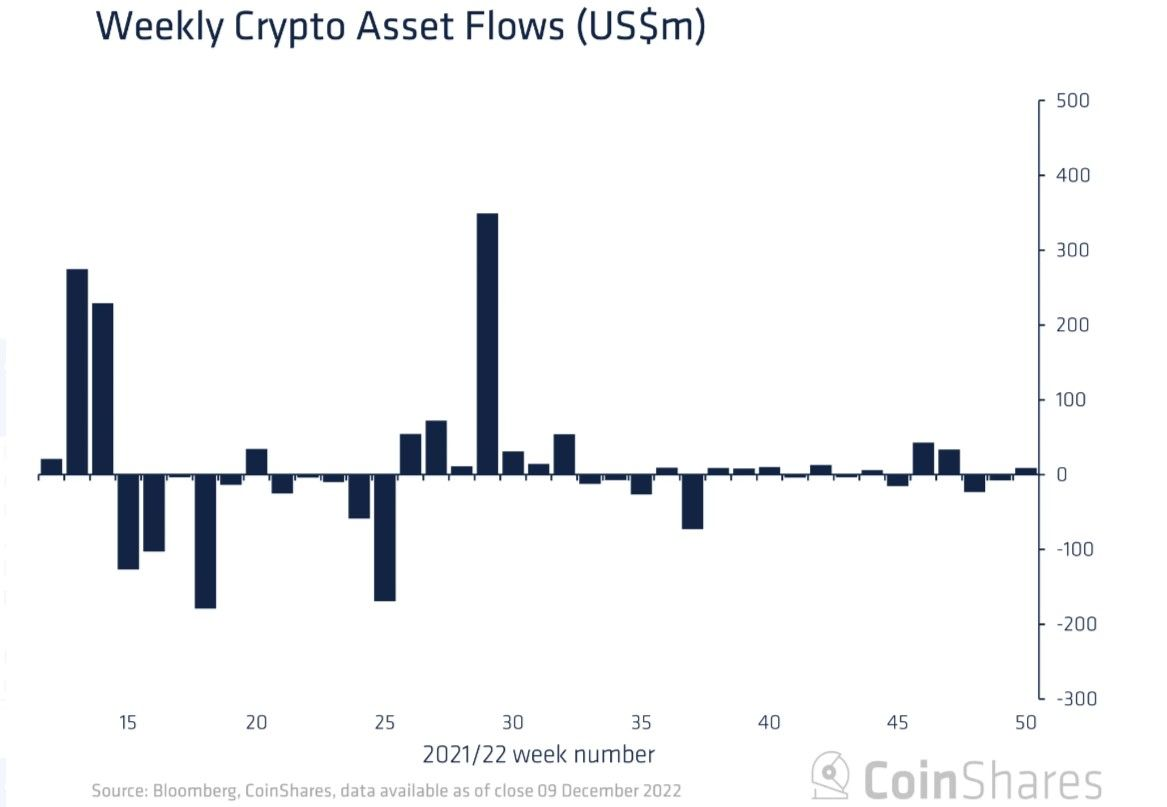

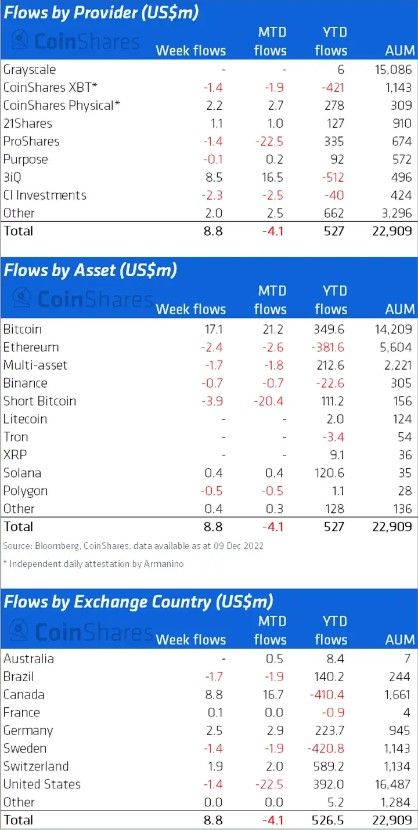

CoinShares reported that last week investors were not very active in investing in cryptocurrencies. In total, $8.8 million was invested in digital assets. Trading volumes reached a new two-year low of $677 million.

Analysts believe that these are good indicators, since investors have been withdrawing money from short investment products for two weeks in a row. $17 million was invested in bitcoins last week. At the same time, investors have been withdrawing assets from short BTC positions for two weeks in a row: the outflow amounted to $3.9 million.

CoinShares experts note that investor sentiment has gradually improved since mid-November, and since then $108 million has been invested in BTC. This is 2.1% of total assets under management (AuM). Analysts note that for four weeks in a row, investors have been gradually withdrawing money from Ethereum. The total amount of withdrawn assets amounted to $2.4 million, and since mid-November, even $22 million.

CoinShares believes that investors still have more faith in Bitcoin than in Ethereum. Crypto investors are generally reluctant to invest in other altcoins. $0.4 million was invested in Solana, and $0.5 million was withdrawn from Polygon.

Due to investors’ concerns about the mining industry, which is faced with low prices for cryptocurrencies, rising interest rates and electricity tariffs, investors withdrew $6.6 million from the shares of crypto companies.

At the same time, the Binance exchange, according to the Coinglass analytical platform, is losing $500 million daily in bitcoins.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.