Crypto asset management company CoinShares reported that amid significant fluctuations in the cryptocurrency market, investors are leaving for bitcoin, not trusting ether and other altcoins.

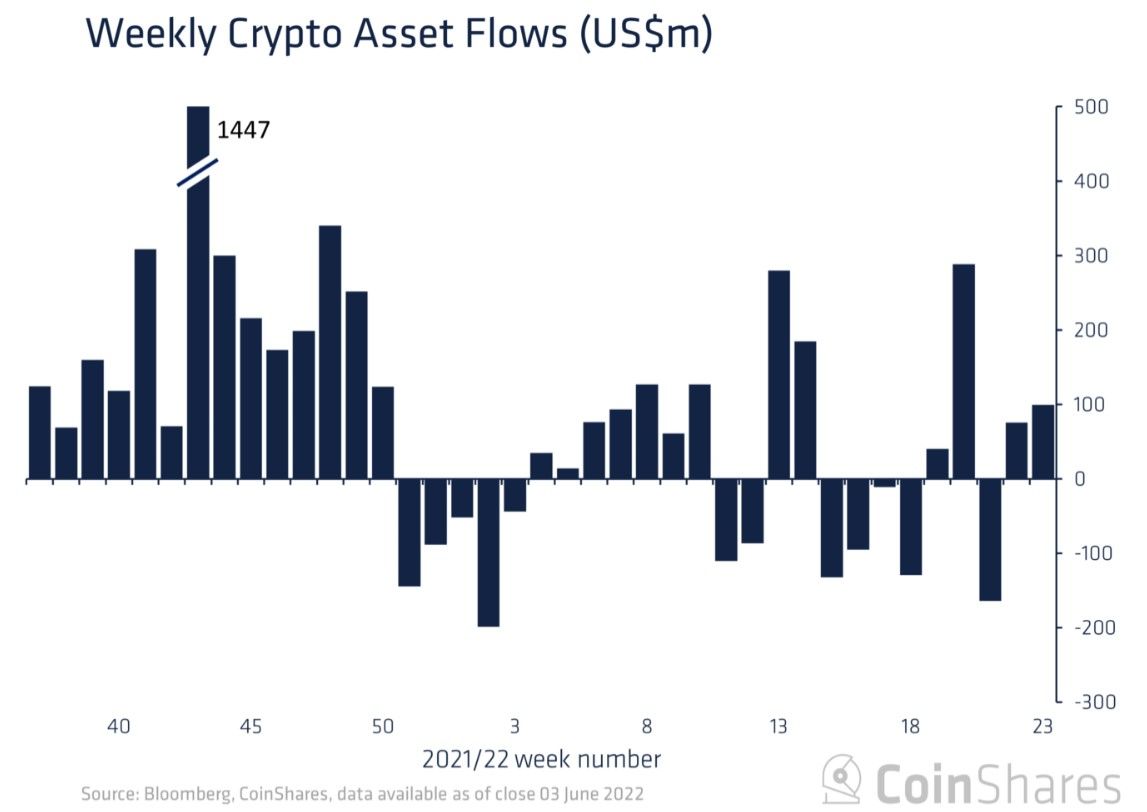

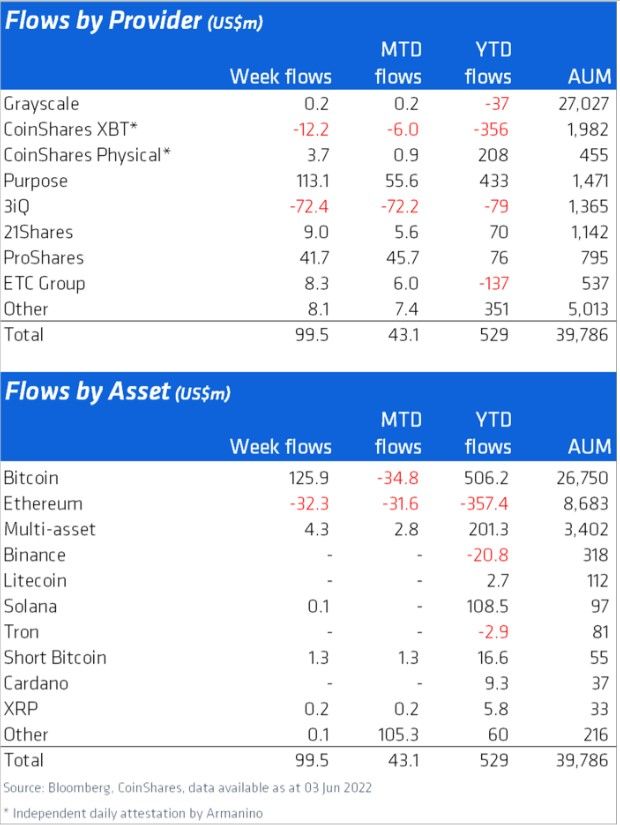

According to the weekly report CoinShares, despite the volatility of the cryptocurrency market, the inflow of funds into the industry amounted to $100 million. Thus, the amount of assets under management reached $39.8 billion.

The authors of the report said that a significant part of the market is occupied by investors from the United States – their investments in the industry last week amounted to $88 million. European investors were much less active and invested $11 million in digital assets.

Last week, capital inflows into Bitcoin funds totaled $126 million, bringing the year-to-date total to $506 million. Bitcoin shorts received $1.3 million inflows last week.

Investments in Ethereum continue to decline – over the past week, the second largest cryptocurrency by capitalization lost $32 million. Thus, Ethereum has experienced the ninth week of outflow of money, which indicates the continuation of the “bearish” mood of investors.

$4.3 million was invested in multi-currency products based on crypto-currencies last week. At the same time, during the period of general negative price movement in the market, this segment has constantly seen a constant inflow of capital. The authors of the report noted that investors were practically not interested in altcoins – in a volatile market, traders found a safer haven, which became bitcoin.

Last week, cryptocurrency investor and co-host of Altcoin Dailyco Austin Arnold opined that Chainlink, Avalanche and Cardano projects are good investment opportunities in a declining cryptocurrency market.

Source: Bits

I’m James Harper, a highly experienced and accomplished news writer for World Stock Market. I have been writing in the Politics section of the website for over five years, providing readers with up-to-date and insightful information about current events in politics. My work is widely read and respected by many industry professionals as well as laymen.