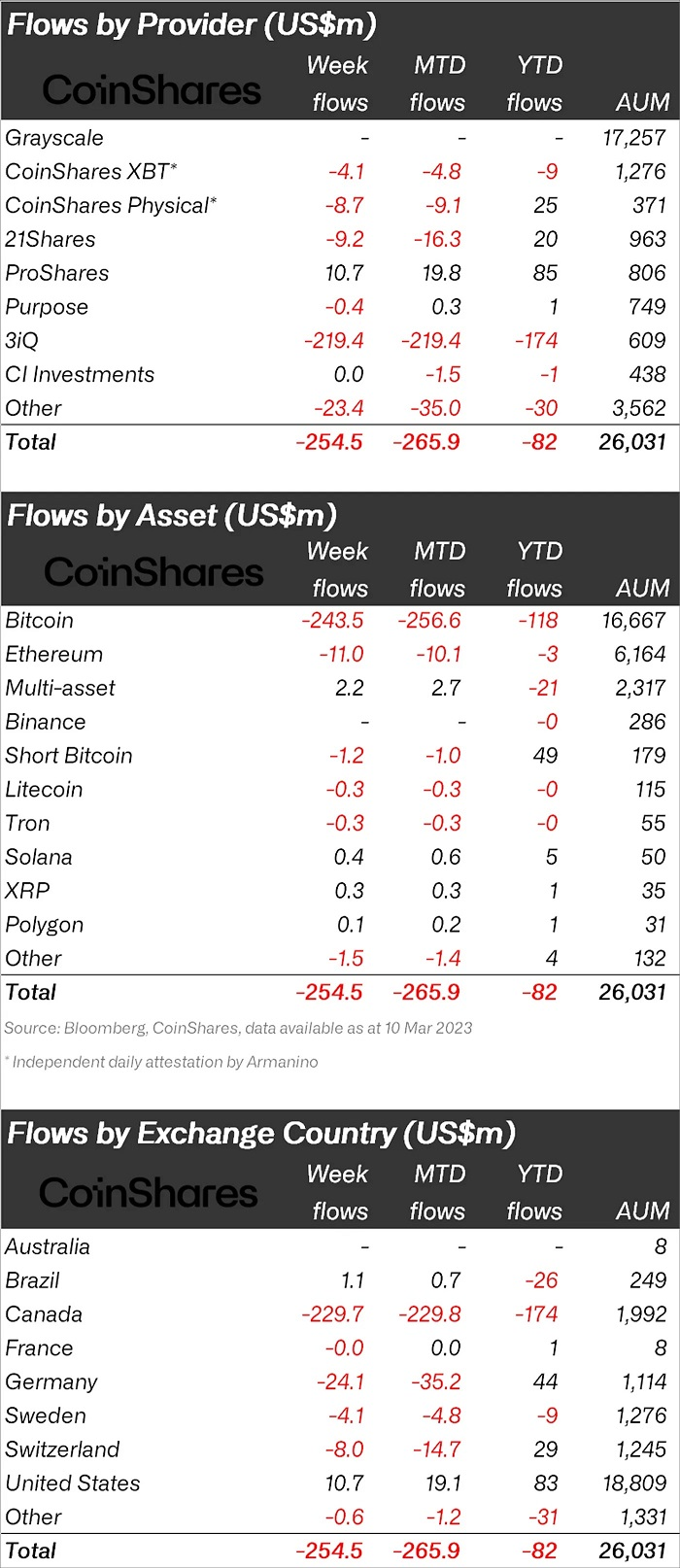

The outflow from cryptocurrency investment products has been observed for the fifth week in a row. However, the withdrawal of $255 million from March 6 to March 10 set a record in the history of such trusts. This is about 1% of the total volume of digital assets in funds and trusts.

True, in May 2019, the outflow for the week amounted to 1.9% of the total, but then it was only $51 million. Since then, the volume of funds in cryptocurrency funds has grown by 816%.

Interestingly, in the US, institutional investors not only did not withdraw funds, but, on the contrary, brought an additional $10.7 million into cryptocurrency funds. A positive inflow of funds was also recorded in Brazilian cryptocurrency products ($1.1 million).

In all other regions, capital outflow is noticeable, with Canada standing out – it seems that one large investor (or several) withdrew $219.4 million from the company’s Bitcoin products at once $3iQ. This is a quarter of the total capital under management of the company. In total, Canadian investors withdrew $229.7 million from cryptocurrency funds.

Most of the funds were withdrawn from bitcoin trusts – $ 243.5 million (the same Canadian investor influenced). Also, the outflow was recorded from funds for ether, short bitcoin, LTC and Tron. But multi-currency funds, trusts on SOL, XRP and MATIC reported an influx of funds, albeit with insignificant amounts.

Earlier, CoinShares reported that the pressure of US regulators on the cryptocurrency industry is leading to an outflow of funds from cryptocurrency funds.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.