Colin Wu, also known in the social network of X under the pseudonym Wublockchain, emphasized that in terms of the number of rounds this is a new minimum of February 2021. And compared with March, this indicator decreased by 15.4%.

In the sectors of the crypto, the leading positions are occupied by projects in the field of tokenization of the assets of the real world (RWA) and decentralized networks (depin). At the same time, on the volume of attracted capital, April demonstrated a new maximum from May 2022 – $ 2.986 billion.

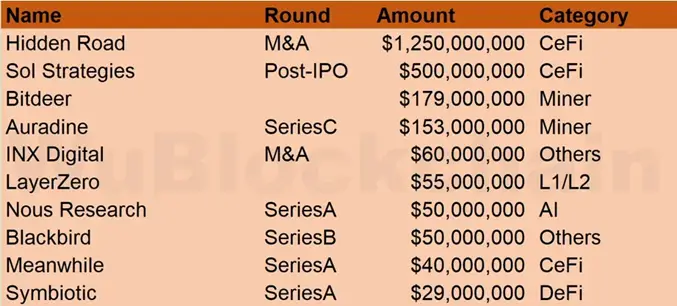

According to the analyst, the largest venture round was the transaction to acquire Ripple Labs by the Hidden Road brokerage company for $ 1.25 billion. Sol Strategies are in second place, attracting $ 500 million by issuing bonds for the ATW Partners investor.

The third line was taken by the Bitdeer mining company. In April, the company was able to attract $ 179 million in the form of loans and joint -stock capital for the modernization of equipment for the production of bitcoins.

Earlier, the analysts of the Coingecko platform said that more than half of digital projects launched since 2021 ceased to exist, which emphasizes high investment risks for cryptornic participants.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.