- EUR / GBP continues to trade sideways between 0.9000 and 0.9100.

- The pair does not show a clear direction with all eyes on Brexit.The euro appreciated slightly on Wednesday after rebounding from support at the 0.9005 / 15 area. The pair, however, remains on the defensive, with limited bullish movements below the confluence of the 20 and 50-day SMAs at 0.9080.

EUR / GBP moving sideways with all eyes on Brexit

In the short term, the euro-pound does not show clear directions, with all eyes on the Brexit negotiations. The resumption of negotiations this week has eased concerns about the consequences of a “hard Brexit”, although the positive impact on the British pound has been mitigated.

EUR / GBP seems likely to remain directionless, moving sideways between the support levels just above 0.9000 and 0.9100, pending the outcome of the talks to define the medium-term trajectory.

On the upside, the pair should break above the trend line resistance at 0.9100 to ease the bearish pressure and confirm the bullish reaction above 0.9145 (Oct 20 high) and 0.9220 (Sept 23 high). ).

On the downside, below 0.9005 (October 14 low), the pair could find support at 0.8911 (61.8% Fibonacci retracement of the May-September rally) and before testing the September lows. at 0.8865.

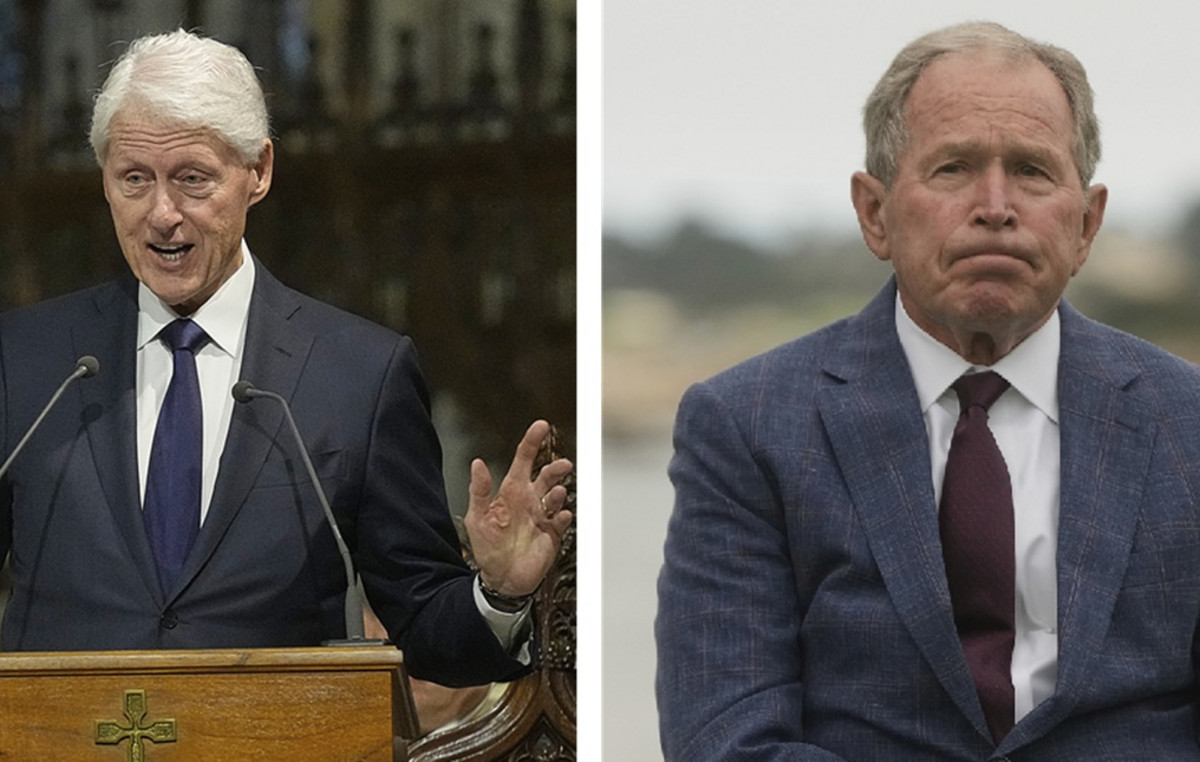

Daily chart

Credits: Forex Street

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.