- The price of copper remains firm as refining restrictions represent a risk to the electronic industry.

- The copper is quoted at $ 5.50, even 10% above its level on Monday, since concerns about tariffs persist.

- Supply risks driven by tariffs generate alarm throughout the construction sector.

Copper futures are negotiating about $ 5.50 per Libra on Friday, falling from the maximum of Tuesday of 5.70 $ in the daily frame. Despite the slight fall, prices remain 10% above Monday’s close, underlining persistent concerns about supply interruptions linked to United States commercial tariffs (USA).

The 50% tariff on copper imports, announced on Wednesday and will enter into force on August 1, aims to consolidate the copper industry in the US and reduce dependence on imported refined products.

The announcement of the tariff has led to the premium among US copper futures and the prices of the London Metal Stock Exchange (LME) reach a 25%record, since foreign indices weakened and prices in the US shot.

This divergence reflects the market expectations that copper flows towards the US would slower after threats initially arose in February.

Merchants accelerated shipments in recent months to get ahead of the August application window. The anticipation of imports temporarily increased reserves in the US, but this is expected to fade, which could lead to domestic scarcity later in this quarter.

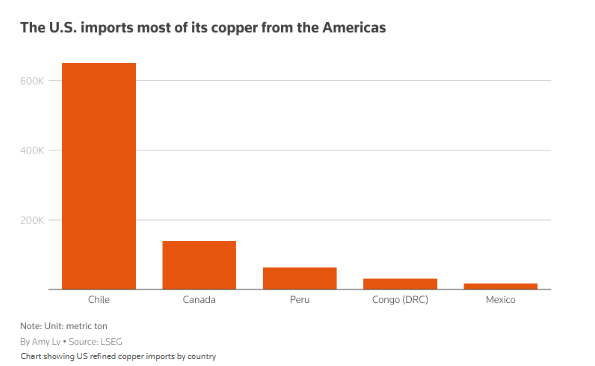

According to a Reuters report on Thursday, the United States imports almost 50% of its copper consumption, Chile being the main supplier of refined copper shipments.

Analysts warn that the US lacks sufficient refining infrastructure to absorb the supply gap. The new capacity could take years to develop, which suggests that Downstream Industries, particularly construction and electronics, could face increasing supplies costs and delivery delays.

The daily chart shows the copper negotiating within an ascending channel in the long term, with a strong volume that supports the recent rupture.

The relative force index (RSI) has decreased from overcompra levels, but remains high, pointing out a continuous bullish trend.

The immediate support is at $ 5.03, followed by a deeper support at $ 4.62 (78.6% FIB) and 4.29 $ (61.8% FIB), where previous consolidation areas could act as shock absorbers in case of a setback.

As the deadline of August 1 is approaching, copper markets are likely to remain volatile.

Tariffs – Frequently Questions

Although tariffs and taxes generate government income to finance public goods and services, they have several distinctions. Tariffs are paid in advance in the entrance port, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and companies, while tariffs are paid by importers.

There are two schools of thought among economists regarding the use of tariffs. While some argue that tariffs are necessary to protect national industries and address commercial imbalances, others see them as a harmful tool that could potentially increase long -term prices and bring to a harmful commercial war by promoting reciprocal tariffs.

During the election campaign for the presidential elections of November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy. In 2024, Mexico, China and Canada represented 42% of the total US imports in this period, Mexico stood out as the main exporter with 466.6 billion dollars, according to the US Census Office, therefore, Trump wants to focus on these three nations by imposing tariffs. It also plans to use the income generated through tariffs to reduce personal income taxes.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.