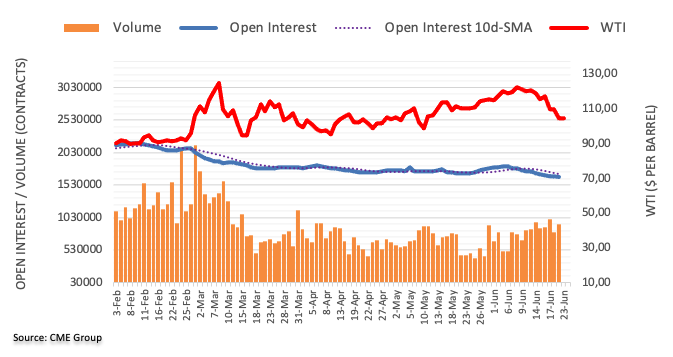

Taking into account the advanced figures from CME Group for the crude oil futures markets, traders reduced their open interest positions by about 6,700 contracts on Wednesday, further extending the downward trend in place since June 7. Volume instead increased by around 113,200 contracts and partially reversed the earlier pullback.

WTI: The $100 level should contain the drop

The prices of WTI pulled back sharply and revisited the $101 zone on Wednesday. The sharp pullback came amid a reduction in open interest and points to the view that a deeper pullback is not favored in the very short term. On the contrary, further decline in commodity prices should find strong support around $100.00.

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.

.jpg)