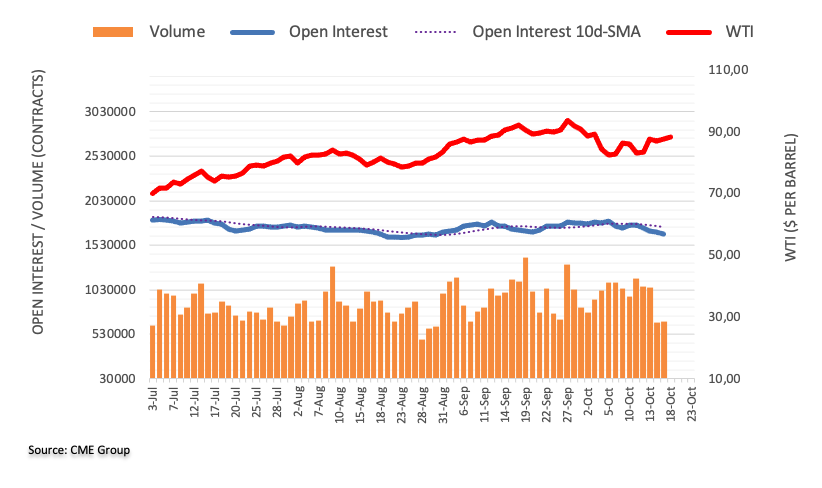

Taking into account CME Group’s advanced data for crude oil futures markets, open interest fell for the fourth consecutive session on Tuesday, now at around 22,700 contracts. On the other hand, volume rose to around 13,500 contracts after three consecutive daily declines.

WTI: The next level up is the yearly high near $95.00

WTI prices resumed the uptrend on Tuesday, leaving behind the daily pullback seen earlier in the week. However, the daily bounce came thanks to the reduction in open interest, which points to the idea that the continuation of the movement does not seem favorable at the moment. Meanwhile, 2023 high near $95.00 per barrel remains next target for bulls.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.