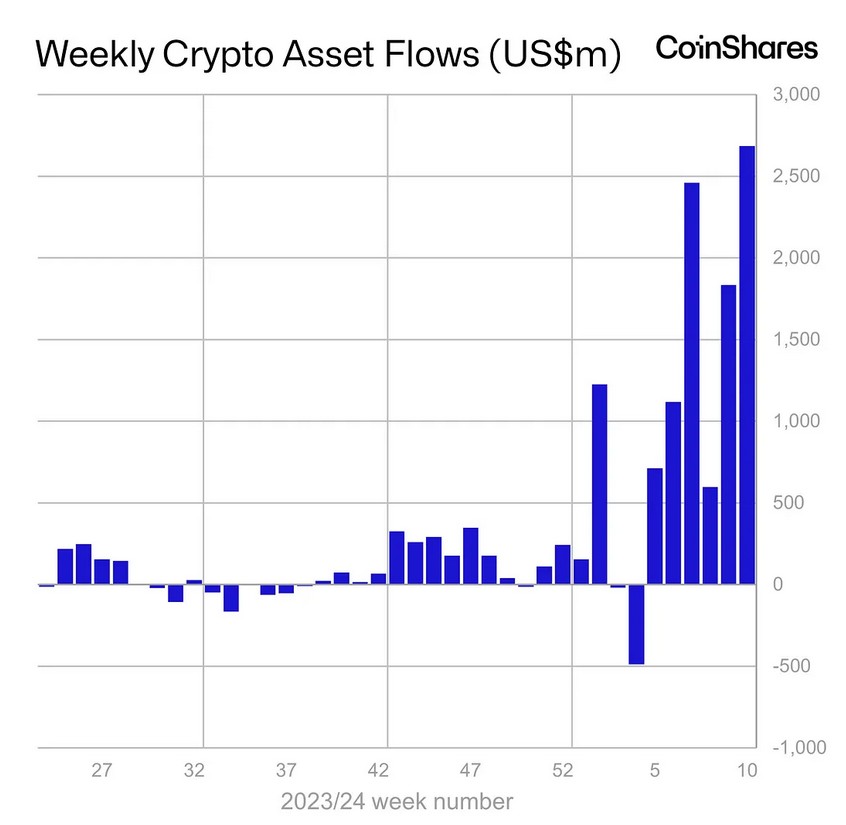

The weekly influx of funds into investment products based on cryptocurrencies set another record.

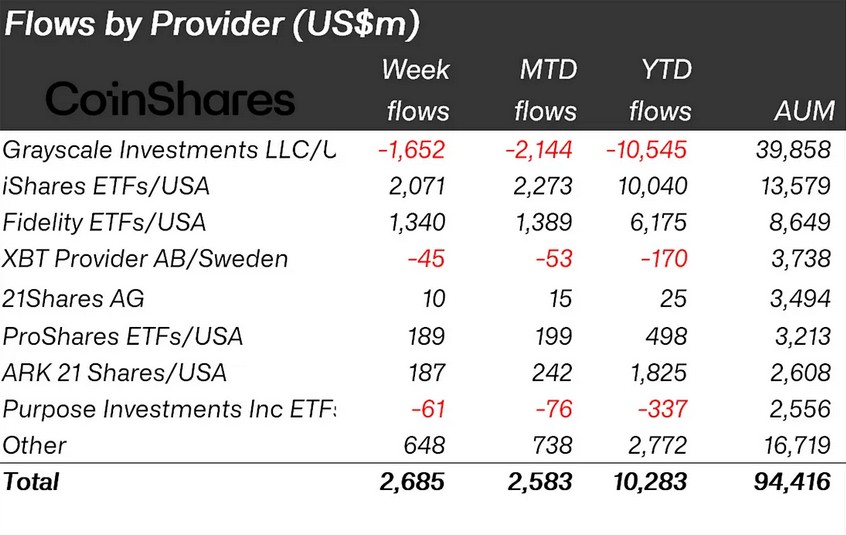

During the week from March 4 to March 8, a total of $2.7 billion was invested in crypto funds. This is stated in the new report CoinShares analysts.

Only records

The total inflow of funds since the beginning of the year reached $10.3 billion. This is only $3 million less than the record figure of $10.6 billion for all of 2021.

The weekly trade turnover also set a new record – $43 billion. A week earlier, it did not exceed the $30 billion mark.

Amid the recent price surge, assets under management (AuM) have jumped 14% for the week and 88% for the year to date. The figure is currently at a record level of $94.4 billion.

Regionally, the United States continues to lead. The United States accounted for $2.8 billion of inflows. In Canada, Germany and Switzerland, meanwhile, investors took profits, so there was an outflow there.

What about crypto

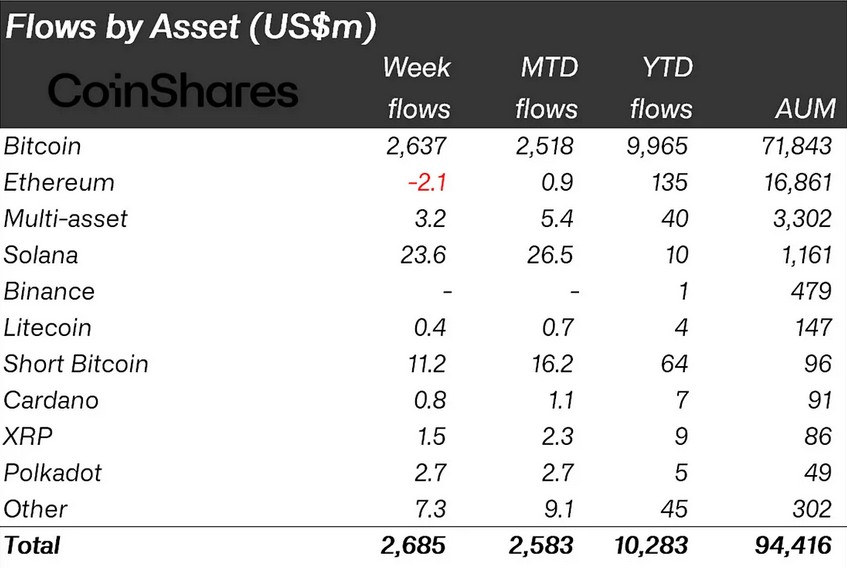

The influx of capital into Bitcoin (BTC)-oriented products exceeded $2.6 billion. Short positions on the first cryptocurrency are also showing positive dynamics. Last week $11 million was poured into them.

Crypto funds for Solana (SOL) finally received $24 million after a negative week. At the same time, in Ethereum (ETH), analysts recorded a total outflow of $2.1 million. With products based on other altcoins, the situation is as follows:

- Polkadot (DOT) – $2.7 million;

- Fantom (FTM) – $2 million;

- Chainlink (LINK) – $2 million;

- Uniswap (UNI) – $1.6 million.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.