Difficulties in identification

Information about the ownership of bitcoins remains closed in many ways. All that can be specified is the addresses of wallets and the number of BTC on them. But it is not known who is the owner of each specific wallet. In addition, the same person – at least a physical, at least legal – can have many addresses. Thus, when it comes to specific figures, you have to rely on either the statements of people and reports of companies, or on assumptions and public information.

The richest bitcoin addresses

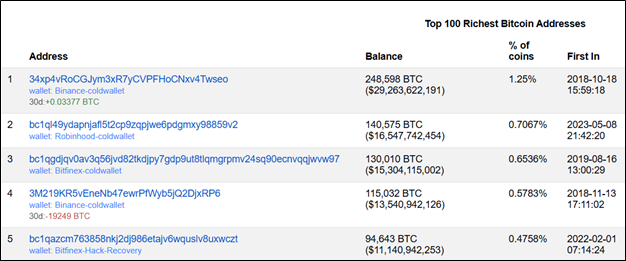

To begin with, we turn to objective data – addresses on which the most BTC is stored. Given that there are a lot of bitcoin wallets, we will consider the five largest. According to Bitinfocharts, it looks as follows:

Source: Bitinfocharts.com

According to the resource, the largest wallet is associated with the Binance crypto -rope. In general, among the richest bitcoin addresses, most of the crypto-rhines, such as Binance and Bitfinex. Cold wallets are also used.

Moreover, only one address contains more than 1% coins. It also says that holders are trying to distribute their accumulations on different storage facilities. In addition, all addresses from the five are relatively young. The oldest of them was first involved in October 2018, that is, nine years after Bitcoin.

Nevertheless, the addresses do not give information about who all these owners of bitcoins from among customers are cryptocurrency. After all, managing customer funds is not the same as owning bitcoins as property. In this regard, we turn to the list of individuals who, presumably, are most bitcoins in their hands.

Individuals

The largest BTC holder is the creator of Bitcoin Satoshi Nakamoto. Periodically, some eccentric characters, like Craig Wright (Craig Wright) or Stephen Mollah, announce that they are the creators of the first cryptocurrency. However, in July 2025, the personality of Satoshi is still shrouded in a secret. No one knows if this is one person or a group of enthusiasts. Nevertheless, according to settlement data, the blockchain analysis, and taking into account the early mining on the network, Satoshi owns almost 1 million BTC (more than $ 144 billion), which are distributed by many addresses. Most of them remain untouched to this day.

The next in the list of large owners are the Tyler and Cameron Winklvoss brothers (Tyler, Cameron Winklevoss). These are the same twins who were involved in the scandal with Mark Zuckerberg and own Gemini crypto accounts. According to their own statements, the brothers have about 70,000 BTC (more than $ 8.2 billion).

Another major bitcoin holder is the venture investor Tim Draper. He has about 29,656 BTC (about $ 3.5 billion). There would be even more coins if Draper had not failed with MTGOX. At one time, he acquired about 40,000 BTC on this crypto -story, which subsequently went bankrupt. Unfortunately, the bitcoins could not be preserved, otherwise the accumulation of the dripper would practically not inferior to the state of the Winklvos.

Well, finally, another major Bitcoin holder is the co -founder of Strategy Michael Saylor. Its personal accumulations are 17,732 BTC (about $ 2.1 billion). It is worth noting that Seilor reserves are not included in Strategy reserves.

From individuals we will move on to legal. Usually the latest money and assets are more than the first. But is it so for cryptocurrencies?

Legal entities

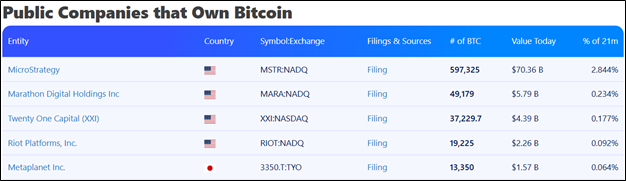

Public companies

We will consider legal entities owning bitcoin by categories. First, we touch on public companies, that is, those whose shares are traded on the exchange. The image below presents five market leaders for July 2025:

Source: Bitbo.io

In the first place is Strategy (former Microstrategy), which is engaged in business analysis, the development of mobile applications and providing services in the field of cloud storages. She has almost 600,000 BTC, which is equivalent to $ 70.36 billion. Next, the Marathon Digital Holdings miner focusing on investments in the Twenty One Capital (XXI), another mining company Riot Platforms and Metaplanet, engaged in the formation of reserves in BTC.

Four of these five organizations represent the United States and only Metaplanet – Japan. Firstly, this suggests that the United States remain leaders of the crypto industry. Secondly, only Strategy has more than 0.5% of the total Bitcoin offer-all other companies do not reach this line. Thirdly, the first five of legal entities in stocks BTC does not reach Satosi Nakamoto together.

Private companies

The image below shows the five largest organizations of this type according to Bitcoin reserves:

Source: Bitbo.io

In the first place is Block.one, which develops software on the blockchain. Its asset has 140,000 BTC (about $ 16.5 billion). This is the only private company whose stocks are more than 0.5% of the total offer of bitcoin. Next are Tether Holdings, which stands behind the largest USDT stabelcoin; XAPO Bank – a digital bank focusing on the integration of traditional finance and cryptocurrencies; Derivatives trading platform for BTIMEX digital assets; as well as a bankrupt MTGOX exchange.

If in public companies the dominance of the United States, then in private the situation is completely different. Not a single representative of the North American continent in the TOP-5. Here are the initiative of Asian legal entities: two companies from Hong Kong and one of Japan. Two other companies represent Gibraltar and Seychelles. It is worth noting that the stocks of bitcoin of the five largest private companies are total less than one public Strategy, what can we say about Nakamoto.

Mining companies

When it comes to the largest owners of BTC, one cannot but mention companies whose activities are aimed at their prey. The image below shows the top seven, given that Marathon Digital and Riot Platforms was already discussed in the section on public organizations.

Source: Bitbo.io

According to these data, miners are not the largest holders. Of course, they have certain reserves, but they do not have to compete with top investors like Strategy. The first seven has a total of less than 100,000 BTC on the hands. None of its representatives have even 0.5% of the total offer of bitcoin. But what is it connected with?

Firstly, with operational costs. To remain competitive, mining companies must constantly monitor the update of equipment, and it costs money. We have to sell a significant part of bitcoins from stocks. Secondly, bitcoin miners are still relatively small enterprises. In other words, they do not have such free resources as large investment companies, for example, BlackRock or Fidelity.

Miners who are the largest holders represent only three countries in the top 7: USA (Marathon Digital, Riot Platforms and Cleanspark), Canada (Hut 8 and Hive Digital Technologies) and Singapore (Bitfufu and Bitdeer Technologies).

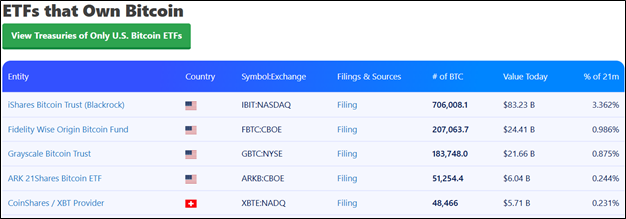

ETF

With certain reservations, the owners of bitcoin include funds traded on exchanges (ETF). Behind them are large investment companies. The largest ETFs are presented in the image below:

Source: Bitbo.io

The largest exchange fund is IBIT from BlackRock. He has a little more than 706 000 BTC (more than $ 83 billion). This is the only fund that has more than 1% of the total amount of bitcoin in circulation. Next are ETF from Fidelity (FBTC), Grayscale (GBTC), Arkinvest and 21Shares (Arkb) and XBTE from Coinshares. It is worth noting that the latter is not an exchange fund, but an exchange product (ETP). XBTE does not directly own cryptocurrency, but uses derivatives for this.

In terms of the ETF palm of the championship, the United States is again: the four of the five largest BTC holders are American companies. In addition, if you summarize the reserves of all funds, they will cost even Satoshi.

Government of the countries of the world

State authorities are another institution that owns serious BTC reserves. According to the data BitboThe leader is the USA, which have 207 189 BTC (about $ 25.16 billion). Most of this reserve was obtained by removing cryptocurrency from scammers. The second place among states is China – in the Middle Kingdom they were able to accumulate 194,000 BTC (about $ 23.56 billion). Further in order are Great Britain, Ukraine and Butane.

It would seem that the countries have a fairly large resource, and they could be very large owners of bitcoin. It is likely that this is so. However, official information speaks of something else. This is due to the fact that the authorities pursue a conservative policy, and a relatively young bitcoin is something alien to them. Here it is worth carrying out of the country’s brackets such as Salvador or the Central African Republic (TsAB). In no country, reserves do not exceed 1% of the total BTC proposal, and the total top five has less coins than Strategy, IBIT, and the more Satoshi Nakamoto.

Defi solutions

Speaking bitcoin, it is worth mentioning its various variations in the market. For example, WBTC wrapped tokens and other alternative, but indirectly related products. The largest analogs BTC are presented below:

Source: Bitbo.io

Although controversial solutions, such as the implementation of bitcoin in other blockchains, are gaining popularity, they are very inferior to the classical first cryptocurrency. WBTC is only a little more than 129,000 – this is about 0.6% of the total Bitcoin offer. Other variations, for example, CBBTC from Coinbase, are less than 0.2%.

Conclusion

Thus, as of mid -2025, the largest bitcoin holder remains its creator Satoshi Nakamoto – he has about 1 million BTC. Following it is IBIT – BlackRock, a spare ETF, which has more than 700,000 coins, and Strategy with almost 600,000 coins. However, in the near future, the change of leader is quite likely. This is due to the fact that BlackRock and Strategy continue their aggressive expansion in the crypton industry, while Satoshi accounts remain untouched.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.