Bitcoin

The increase in the cost of bitcoin from April 25 to May 2, 2025 amounted to 2.54%. The price of the first cryptocurrency again rose above $ 97,000, which did not happen since February 21, that is, two and a half months. Positive dynamics in the week developed due to trading sessions on May 1 and 2.

Source: TradingView.com

One of the reasons for the BTC growth was positive news from the stock market. This week, the largest companies of the so -called “magnificent seven” (Magnify Seven) began to report. The revenue results for the first quarter of the year, for example, Microsoft were higher than expectations. This shows that American business is quite stable and so far is little susceptible to import duties, which is so feared Investors. Considering that the situation has become clear a little, the appetite to risky assets among speculators, such as Bitcoin, also grew up.

But economic statistics in the USA in the week were not encouraging. GDP for a year fell by 0.3%. This contrasts greatly with a 2.4%growth, which was

Showed In the fourth quarter of last year. In addition, the number of applications for unemployment benefits last week

it turned out Significantly higher than expectations (224,000) and amounted to 241,000. The weak data increased the number of speculations on the topic of a possible recession in the United States, to prevent which the Fed may resort to a decrease in the key rate. For example, this opinion

adheres to Famous cryptoanalyst Michael Van Van de Poppe):

“A big miss on GDP. Rumors about a possible recession are growing, which should strengthen the position on the softening of the Fed’s policy. We will probably see the bottom in the markets, liquidity will be added, and risky assets will flourish. ”

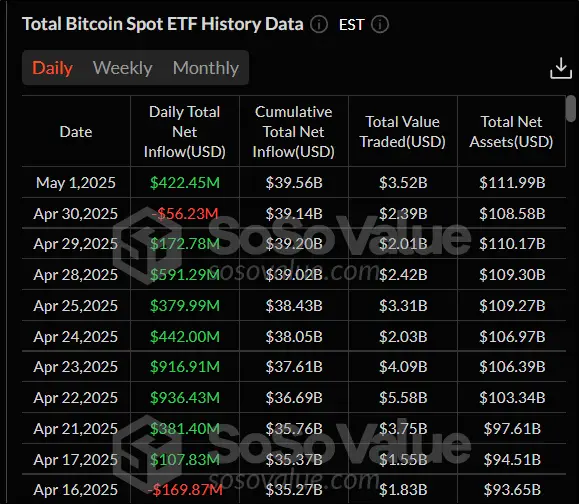

On April 30, a series of eight trading sessions was interrupted by the Bitcoin spotto on Bitcoin when the tributaries of funds were recorded. However, on May 1 there was an influx of money. The total weekly dynamics remains positive. In total, from April 28 to May 1, the flow of funds amounted to $ 1.13 billion.

Source: sosovalue.com

From the point of view of technical analysis, Bitcoin is in an upward trend. In favor of this, an excess at the price of a 50-day sliding average (indicated in blue) is indicated in favor of this. It is worth noting that the bull trend is gradually intensifying. This is evidenced by the growth of the ADX indicator, which already exceeds the value of 30. The support and resistance levels remain unchanged: $ 89,164 and $ 100,000, respectively.

Source: TradingView.com

Index

Fear and greed He rose compared to last week by seven points. The current value is 67. This suggests that greed over fear still prevails in the moods of crypto -investors.

Ethereum

Air from April 25 to May 2 went up by 3.2%. The second in capitalization of cryptocurrency continues to bargain above $ 1,800. There are no sharp fluctuations. All week, ETH trade took place in a narrow range between $ 1,733.2 and $ 1,873.2.

Source: TradingView.com

Despite the increase in the cost of the broadcast in recent weeks, investors are still not waiting for rally. Most of the crypto enthusiasts believe that ETH should still update minimums in 2025. On the Polymarket betting portal, 38% of respondents suggested that the broadcast will drop to $ 1000 by the end of the year. The weak indicators of the network, as well as the inflationary nature of the cryptocurrency, are called the fault.

Source: Polymarket.com

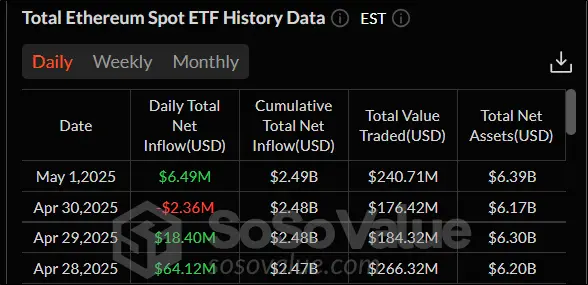

But the weekly dynamics of spotes ETF on the air was positive. In only one trading session, an outflow of funds was recorded, while the other three were marked by an influx of money. The total injections of investors into exchange funds on the air for a week amounted to $ 86.65 million.

Source: sosovalue.com

In the week, it became known about the timing of the next hardcore of the Ethereum. Fusaka update is planned to be implemented in the second half of 2025. Accurate

Dates will be declared later. At the same time, the initial implementation of the EOM (a series of changes in the EVM protocols), which was planned to be carried out as part of Fusaka, was canceled. By

opinion The leading developer of the Ethereum Tim Beiko, this function would lead to technical uncertainty and the possible transfer of the hardforn.

From the point of view of technical analysis, the broadcast is in the growth phase. In any case, indicators speak in favor of this. The price has finally surpassed a 50-day sliding average (indicated in blue). In addition, the RSI is growing and has already risen higher than the mark of 50. Support and resistance levels compared to last week have remained unchanged: $ 1754.2 and $ 2112, respectively.

Source: TradingView.com

SUI

The cost of the SUI coin from April 25 to May 2 decreased by 0.94%. All week, crypto -investors unsuccessfully tried to gain a foothold above $ 3.8. Nevertheless, SUI continues to bargain near its maxims of the last two and a half months.

Source: TradingView.com

The positive news for the cryptocurrency was its high rating from the large management company Grayscale. According to its representatives, SUI builds the infrastructure by union Web2 and Web3. Smooth asset management and exchange of private data on the network using artificial intelligence

allow Developers to simplify blockchain, payments and integration with the world of real assets – when using tools that are understandable to users.

On May 1, it became known that the 21SHares investment company filled out an application for a Sui spot on Sui and submitted it to the US Securities and Exchange Commission (Sec). This is the second similar case. Earlier in March, the financial company Canary Capital also applied to the Sui Sui SPOT. So, among investors there is a demand for exchange funds for this cryptocurrency. Costs

Markthat immediately after the release of the news about the application 21SHARES, the cost of SUI flew by more than 10%.

Analytical platform

Santiment Published a list of cryptocurrencies with the greatest activity of the developers on GitHub over the past month. SUI in this indicator entered the TOP-10, taking eighth place with 329.87 commits (separate changes in files). First place

Got it IEXEC RLC with 854.4 commits.

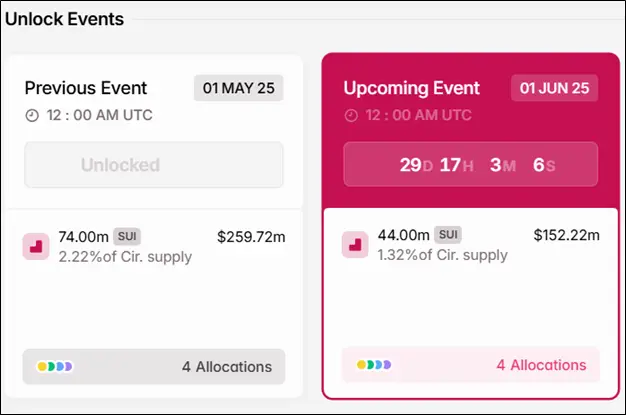

And on May 1, a planned unlock took place 74 million (about $ 260 million) of SUI tokens. Thus, the supply of coins increased, which was supposed to lead to a decrease in cost. Nevertheless, investors reacted quite restrained to issue. On May 1, SUI went up by 1.28%. The next unlocking is scheduled for June 1, when another 44 million SUI tokens will enter the circulation.

Source: tokenomist.ai

From the point of view of technical analysis, SUI is in an upward trend. This is evidenced by excess at the cost of a 50-day sliding average (indicated in blue). Interestingly, the Parabolic SAR indicator (the orange line on the graph) showed a trend even earlier – April 11. The 50-day sliding average price overcame only on April 22. The further growth of SUI will depend on whether the cryptocurrency can gain a foothold above the resistance level of $ 3.895. The support level is at least the past week – $ 3.273.

Source: TradingView.com

Conclusion

Despite rumors about the upcoming recession in the United States, for cryptocurrencies, the week passed without shocks. And bitcoin, and ether, and Sue are in an upward trend. The main positive factors for weeks were news related to American statistics and spotes ETF.

This material and information in it is not an individual or other other investment recommendation. The view of the editorial office may not coincide with the opinions of analytical portals and experts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.