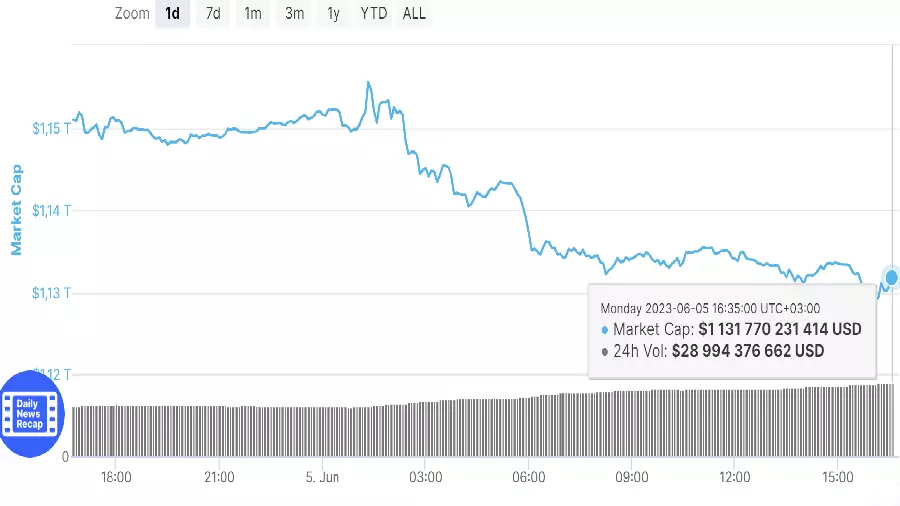

As of Monday afternoon, June 5, the crypto market is seeing a net outflow of around $24 billion. The total market capitalization has dropped from $1.155 trillion to around $1.131 trillion.

The market capitalization of bitcoin and ether fell by 1.84% and 2.04%, to $518.4 billion and $224.4 billion, respectively. On the afternoon of June 5, the BTC is trading at $26,736, while the overall dominance of Bitcoin in the market has fallen to 45.8%.

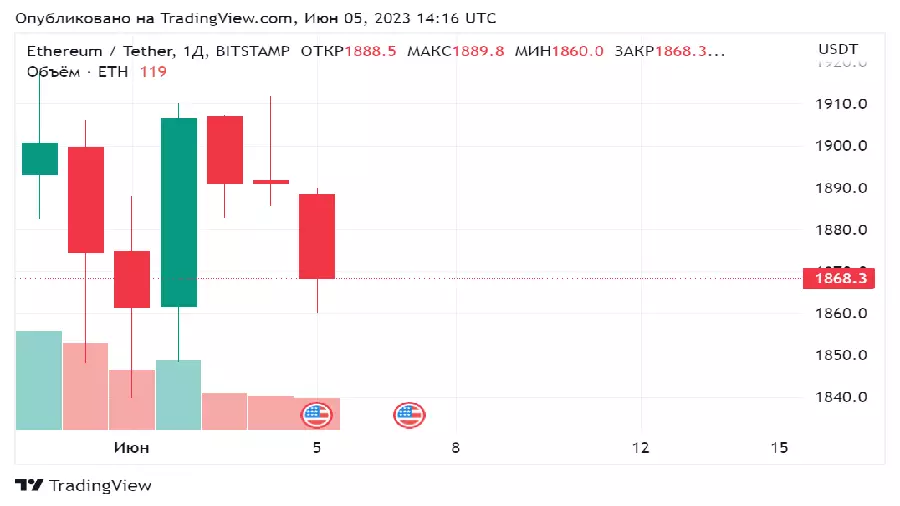

Taking into account the losses over the past day, the market value of ETH is about $1870. At the same time, the share of ether in the crypto market increased from 19.7% to 19.8%.

In 24 hours, BNB, ADA and SOL showed the largest rebound, losing 2.35%, 2.21% and 2.31% respectively.

The adoption of a new ceiling on the US government debt could encourage some crypto investors to move funds from risky assets to safer ones, such as government bonds.

On Saturday, June 3, the analytical service Kaiko provided data according to which the volume of trading on centralized cryptocurrency exchanges decreased to $5 billion per day. The same indicators were in 2020, before the massive increase in the bitcoin rate.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.