The high volatility of the cryptocurrency market does not scare investors. The number of cryptocurrency holders remains stable or even grows.

IN latest Gemini report dubbed the “2024 Global State of Crypto,” it notes the strong commitment of investors from the US, UK, France and Singapore.

Retail Investors Aren’t Selling Crypto

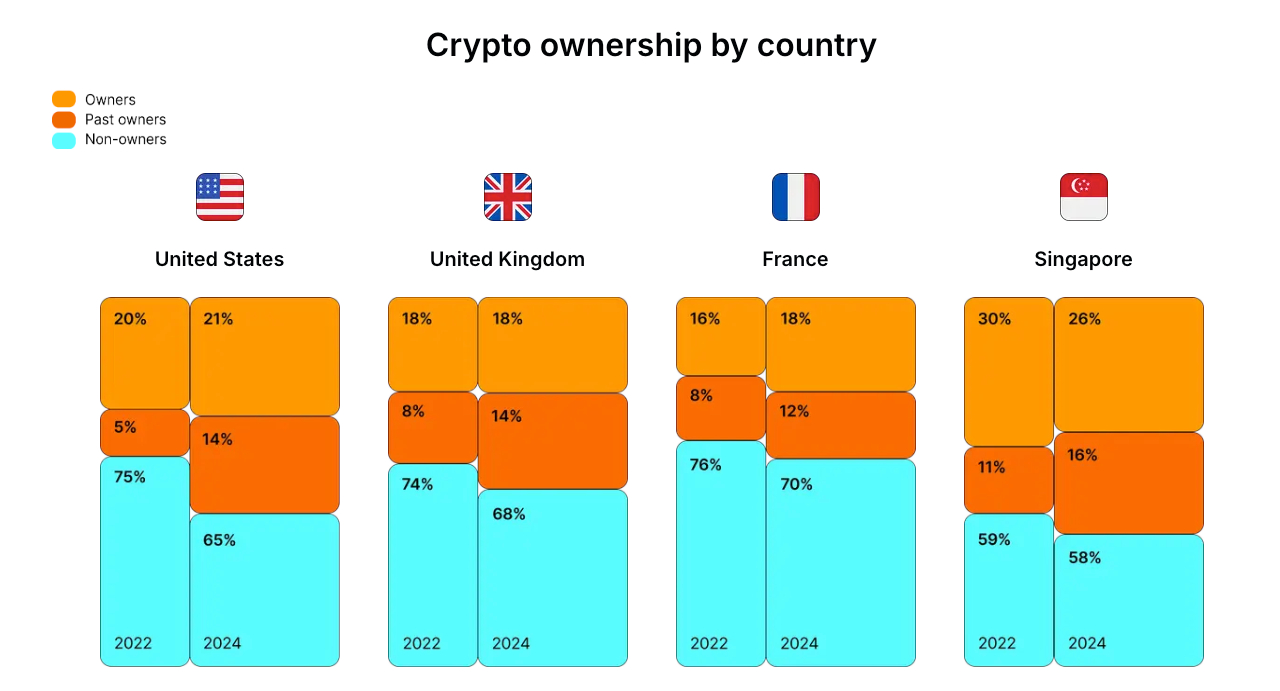

In the US, 21% of adults own cryptocurrency, which is the same as last year. A similar situation is observed in the UK, where the number of digital asset holders is consistently estimated at 18%.

In France, the share of cryptocurrency owners increased from 16% in 2022 to 18% this year. In Singapore, on the other hand, this figure fell from 30% to 26%.

Cryptocurrency Ownership by Country. Source: 2024 Global State of Crypto

Cryptocurrency Ownership by Country. Source: 2024 Global State of Crypto

The motivation of digital asset holders is clear — a huge part of them believes in the potential of long-term investments. Thus, 65% of respondents in the mentioned countries buy and store cryptocurrency with an eye to the future. In addition, 38% consider crypto assets as a means of protecting against inflation. This indicates a strategic approach of investors to a volatile market.

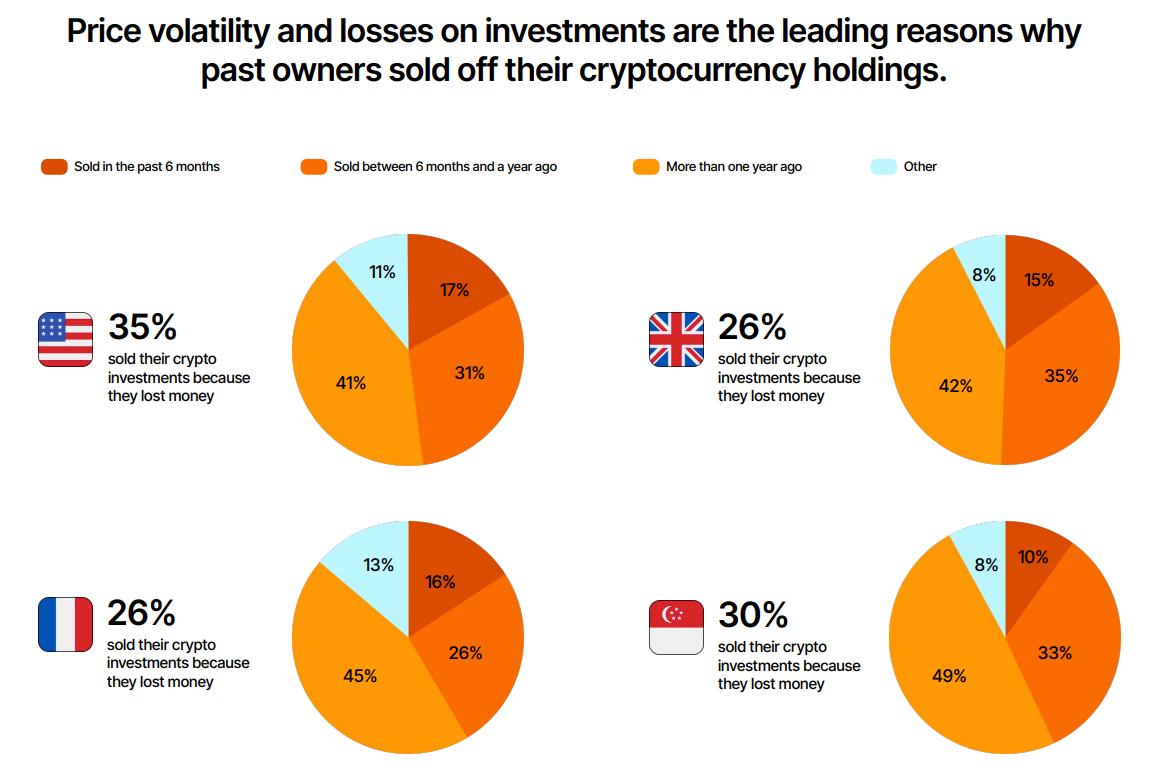

However, crypto investors’ enthusiasm is not limited to just holding. According to the survey, crypto investors have become calmer and more confident about the future. In Singapore, for example, only 10% of cryptocurrency holders have liquidated their assets. At the same time, 49% last sold their assets more than a year ago.

Moreover, many who left the market are now ready to return. More than 70% of former digital asset owners are considering investing in cryptocurrencies again within the next year.

Among current crypto investors, 57% are looking to allocate a significant portion of their investment portfolio to cryptocurrencies.

Cryptocurrency sales have slowed over the past six months. Source: 2024 Global State of Crypto

Cryptocurrency sales have slowed over the past six months. Source: 2024 Global State of Crypto

All the above data is confirmed by another study, but from the data aggregator CoinGecko. Thus, 54.1% of investors remain optimistic about the long-term potential of the crypto market. Despite some bearish sentiments (31.6%), a significant part of developers (47.6%) continue to believe in the stability of cryptocurrencies.

Many investors were drawn to the cryptocurrency ecosystem by the launch of Bitcoin (BTC) spot exchange-traded funds (ETFs) earlier this year. Nearly two in five U.S. digital asset holders now hold part of their portfolio in crypto ETFs. About 13% of them own cryptocurrency exclusively through these funds.

Stay up to date! Subscribe to World Stock Market on Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.