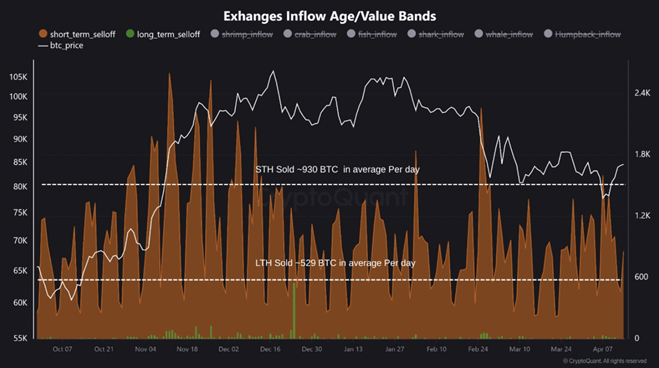

Cryptoquant reported that the last 15 days there has been a stable pressure of sellers on centralized sites.

“Real pressure comes from retail and medium -term players, as well as from very nervous short -term owners. Bitcoin no longer behaves as a safe asset. This is a classic “knocking out weak hands” in the market, analysts said.

According to them, “long -term owners” moved only 529 BTC per day, which indicates fear or fixation of profit only among “short -term players”. Those who store from 100 BTC to 1000 BTC are sent to 402 BTC crypto -rhinas, and owners of more than 1000 coins are sold only for 70 BTC.

Against the background of the lateral movement of bitcoin and reduction of volatility, such an analysis helps to understand that the change in the price of the asset is caused by the actions of investors who are afraid of protracted correction in the market, experts say.

Earlier, 10X Research CEO, Markus Thielen, said that the Bitcoin rally had stopped and the prolonged consolidation phase, which is indicated by short -term indicators, began.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.