Analysts at the Korean company CryptoQuant believe that market volatility has not stopped the accumulation of bitcoins by large investors.

CryptoQuant CEO Ki Young Ju posted on Twitter a series of posts in which he claims that large investors have found opportunities to continue to save bitcoins, despite the volatility of the exchange rate. According to the head of CryptoQuant, “institutional investors are buying bitcoins right now through market makers.”

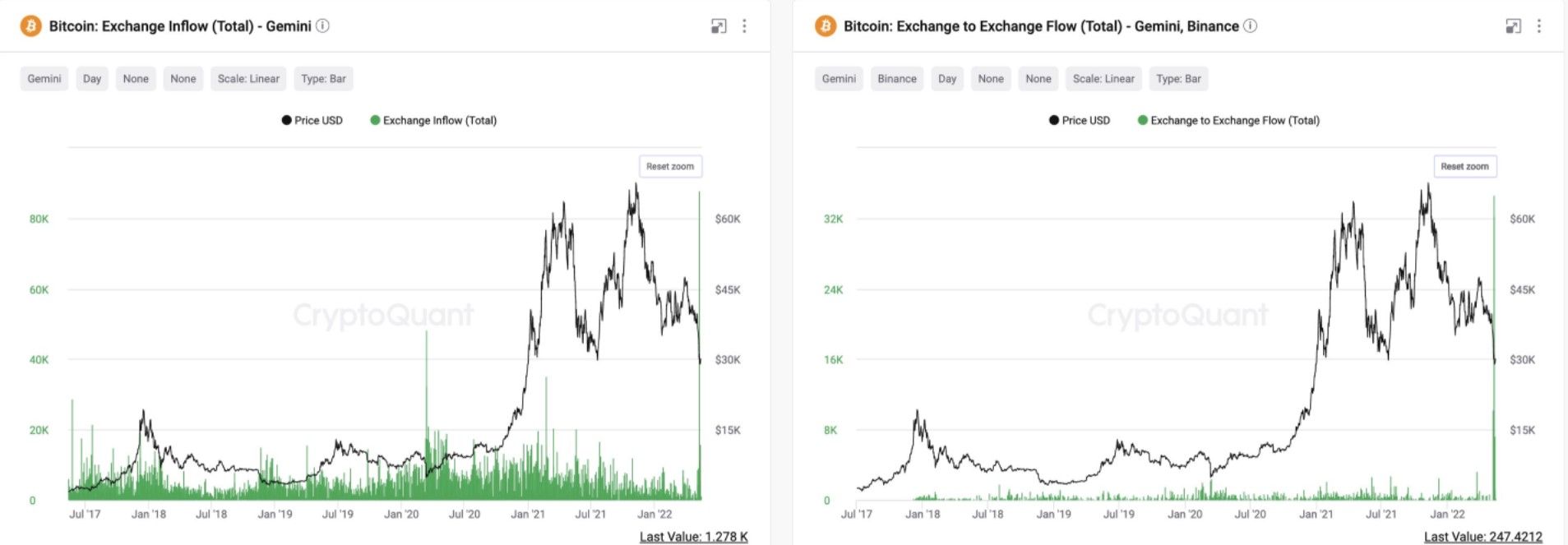

Yang Ju states that large cryptocurrency exchanges are very popular among corporate investors. So, on May 7-10, investors sent about 84,000 bitcoins from the Gemini crypto exchange to the Binance trading platform, thereby reaching a historical maximum:

The head of CryptoQuant believes that most of the selling pressure came from Coinbase as they had the largest bitcoin inflow from Binance. BTC/USD spot trading volume on Coinbase reached a yearly high and Coinbase Premium hit a three-year low of -3%. Yang Ju added that market makers sent $2.5 billion worth of BTC to exchanges last week.

Kee Yang Joo summarizes that “large organizations tried to set the price of bitcoin at $30,000, but they had to stop at $25,000 due to the unexpected sale of the Luna Foundation Guard (LFG).”

Last week, specialists from the management company CoinShares noted that the global fall in the cryptocurrency market contributed to an increase in investment in bitcoin among institutional investors.

Source: Bits

I’m James Harper, a highly experienced and accomplished news writer for World Stock Market. I have been writing in the Politics section of the website for over five years, providing readers with up-to-date and insightful information about current events in politics. My work is widely read and respected by many industry professionals as well as laymen.