The “Open Interest” indicator measures the total number of BTC futures contracts that are currently open on derivatives exchanges. When the value of the indicator grows, it means that investors are opening new contracts right now. However, in most cases, along with the growth of open positions, the leverage also increases, and this trend can lead to the price of a crypto asset becoming more volatile.

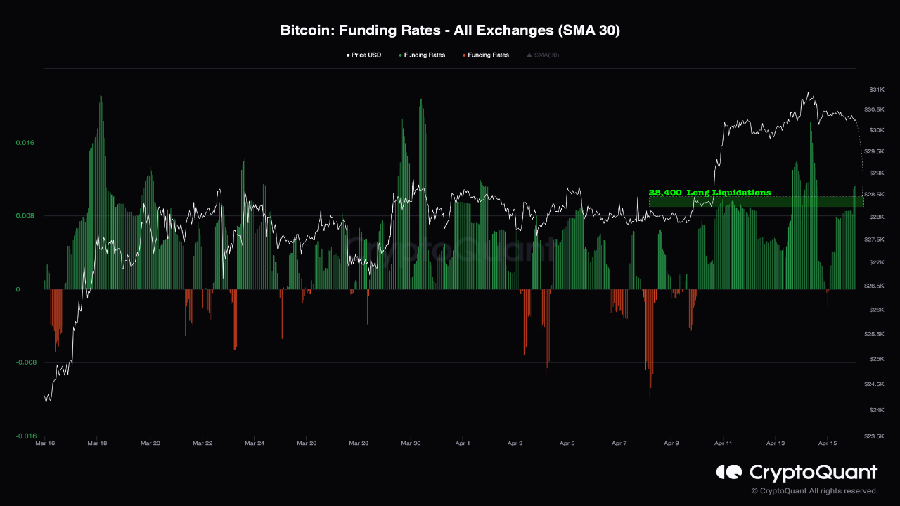

Another relevant indicator is the “funding rate”. This is the name of the payments that traders in the futures market exchange with each other. When the indicator is positive, it indicates that at the moment long positions are paid by short ones, and bullish sentiment prevails in the market. Negative values show that the majority share the “bearish expectations”.

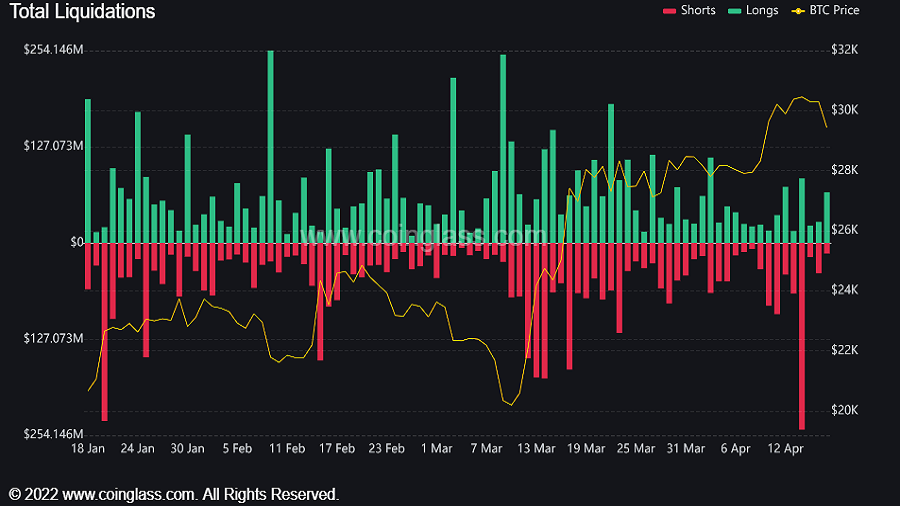

CryptoQuant provides graphical data demonstrating that the number of open long positions exceeds the number of short ones, and therefore is accompanied by significant open interest and a high probability of liquidation of positions. Indirectly, the conclusion of CryptoQuant experts was confirmed by analysts at the CoinGlass platform. According to data from CoinGlass, the bitcoin market has seen a sell-off over the past day, with most of the liquidated contracts being long contracts.

During the day were

eliminated positions of about 40,000 BTC traders, and the total amount of such transactions reached $122.39 million. The largest one-time liquidation order worth $3.03 million was recorded on Binance. On the evening of Monday, April 17, Bitcoin is trading at $29,360, showing a daily decline by 2.8%.

Earlier, bitcoin analyst Willy Woo shared macro indicators on Twitter, confirming, in his opinion, the upward trend of the first cryptocurrency in terms of capitalization.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.