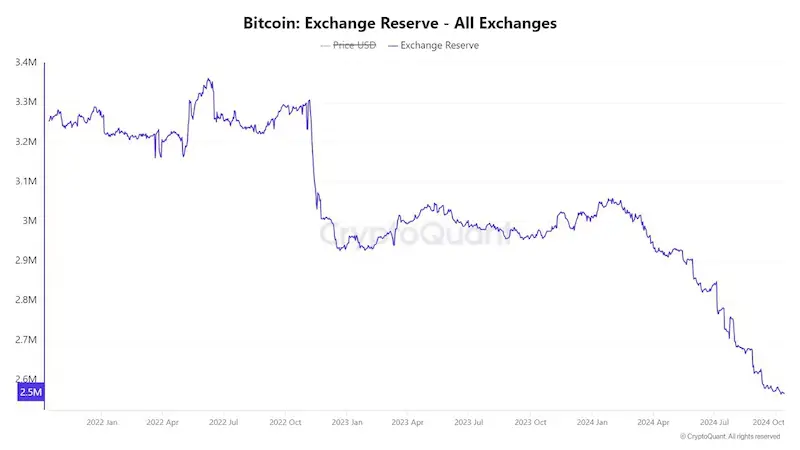

The highest volume of Bitcoin reserves on CEX was recorded on June 8, 2022 – 3,361,854 BTC. There are currently approximately 1.1 million BTC and 8.4 million ETH held on spot exchanges, and approximately 1.39 million BTC and 10.3 million ETH held on derivatives exchanges.

The leaders in terms of Bitcoin and Ether reserves are: Binance (563,000 BTC and 3.6 million ETH), Kraken (112,300 BTC and 1.3 million ETH), as well as Coinbase (4.5 million ETH) and Coinbase Advanced (830,530 BTC).

CryptoQuant believes that the decline in Bitcoin and Ether reserves demonstrates the growing demand in the crypto community for self-custody solutions. Crypto investors prefer to hold flagship crypto assets on their balance sheet in anticipation of growth, rather than taking profits from short-term surges in value.

Earlier, CryptoQuant analysts said that against the backdrop of panic among small speculators, Bitcoin whales took advantage of the situation and bought more than 24,000 BTC.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.