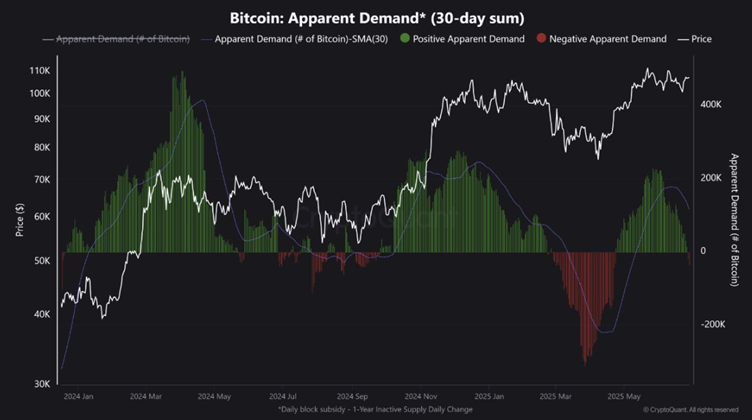

According to analysts, an environment with an increased risk of Bitcoin price correction is formed. The new demand does not have time to compensate for the growing pressure from the miners and the sales of long -term owners.

“Such an imbalance between a proposal and demand creates a risky environment with a high probability of short -term price correction and indicates a hidden weakness of the market,” experts said.

They drew attention to the increased activity of a number of investors, the sales of which signal that Bitcoin has reached a local price maximum.

At the moment, the Bitcoin market is in an extremely vulnerable position. Possible price rally will most likely face obstacles due to excess supply. The level of support for the first cryptocurrency may be weaker than previously expected, summarized in Cryptoquant.

Earlier, Glassnode analysts reported that the Bitcoin course has been held in the consolidation zone since May, but without the resumption of strong demand by investors, new maximum prices look unlikely.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.