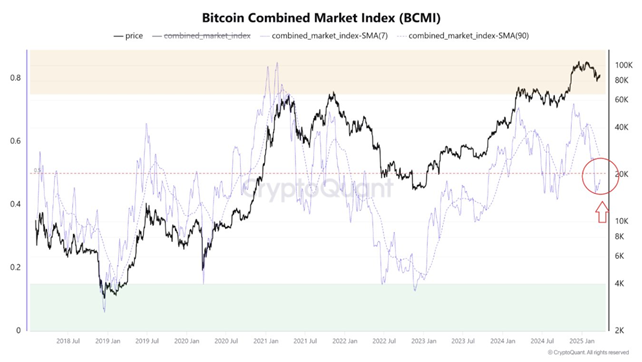

According to analysts, the BCMI indicator below 0.15 indicates extreme fear and is a signal for a possible purchase of an asset. If the indicator is above 0.75, this signals the extreme greed, which precedes the correction of the first cryptocurrency.

“In this market cycle, BCMI has not yet reached a typical“ overheated ”level (above 0.75). Now it is below 0.5, which indicates a key market moment for bitcoin, ”experts said.

Cryptoquant noted that high -risk assets as a whole showed growth. Leading altcoins showed an average of stronger growth than the first cryptocurrency, but she has an advantage in the near future.

Analysts also drew attention to the fact that Gamestop (GME) announced investment in bitcoin in the amount of $ 1.3 billion.

“Although this is not the first case, the symbolic weight of the GME status as a promotion-meme can revive speculative excitement among retail participants. As the experience of 2021 shows, retail flows, if they are coordinated, can challenge institutional positions, ”experts suggest.

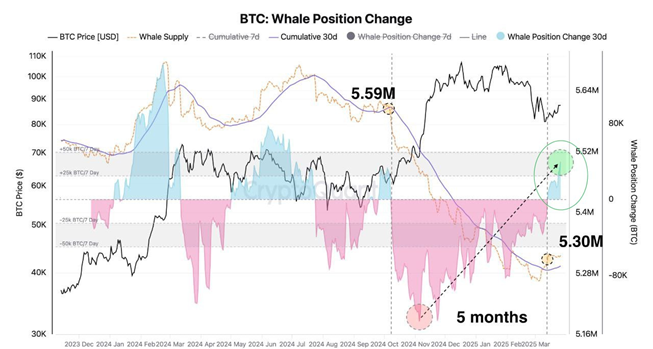

In addition, the BTC offer on exchanges continues to decline, and whales-owners of wallets with a balance of over 1,000 BTC-began to actively buy after 5 monthly sales.

Cryptoquant expects the more volatility of bitcoin in the side trend until April 2 – the date when the introduction of new trading duties in the United States is expected. The market lacks clarity regarding the scale and terms of these measures, and many investors took a wait -and -see position, experts summed up.

Earlier, the economist and founder of Cane Island Alternate Advisors Timothy Peterson said that this year Bitcoin could reach new peaks with a probability of 75%.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.