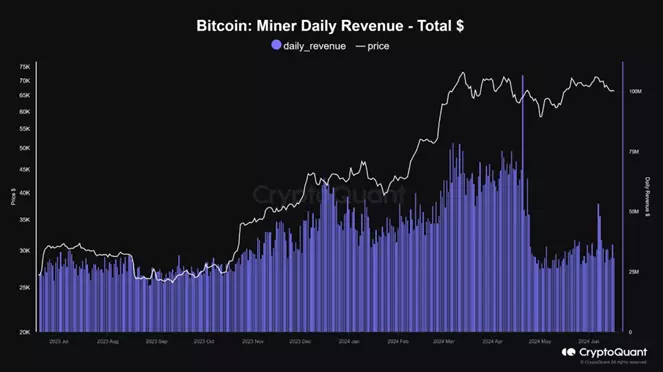

Another reason for the fall in the value of Bitcoin is the decrease in miners’ income by 55%, which forces them to sell more and more coins to cover expenses.

Another reason: the cessation of issuance of new stablecoins USDT and USDC. According to experts from CryptoQuant, as a result, the influx of new funds into the market has almost dried up.

“Historical trends show that periods of low miner income coupled with high hashrate may indicate a market bottom. The support level around $62,400 could help stabilize prices in the near term,” CryptoQuant experts believe.

Now, in addition, there is a significant outflow of capital from shares to spot Bitcoin ETFs. And this is another reason for the fall in quotes of the first cryptocurrency.

Previously, the co-founder of the American software developer MicroStrategy, Michael Saylor, predicted Bitcoin’s growth to $8 million.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.