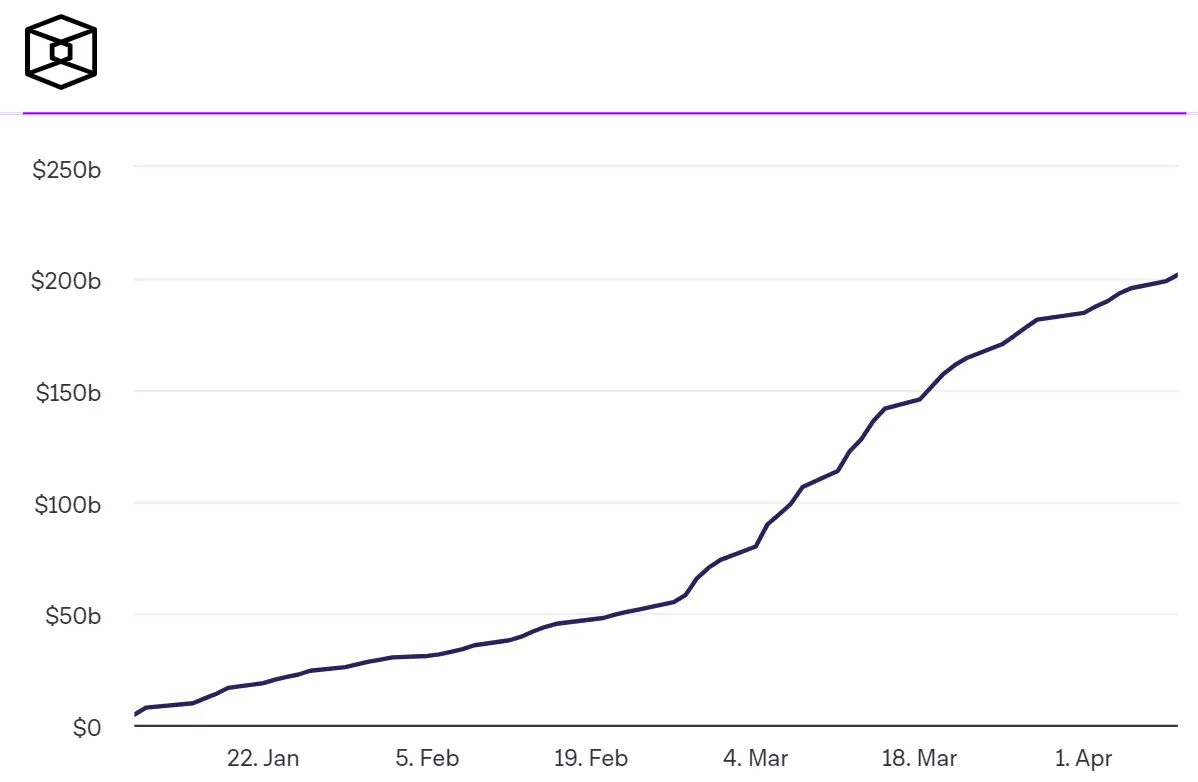

The result was achieved less than three months after the Securities and Exchange Commission (SEC) approved spot BTC-ETFs from investment funds like BlackRock, Fidelity, and Bitwise.

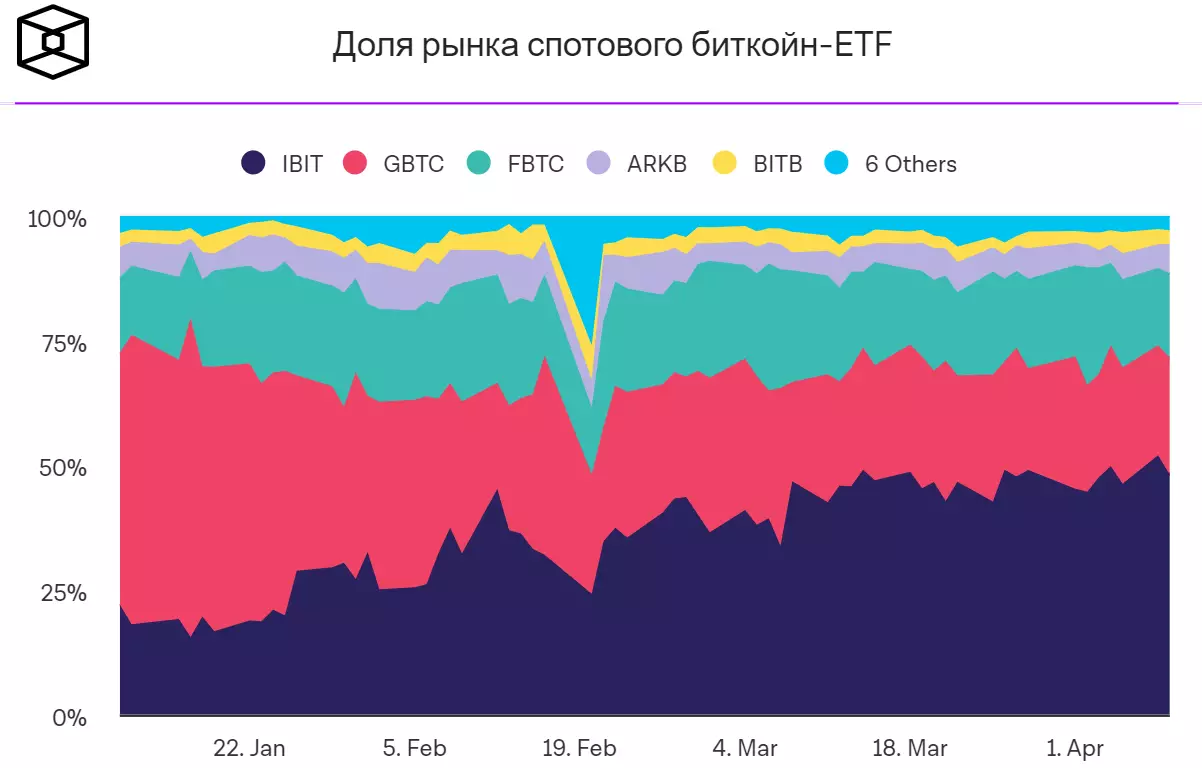

The main drivers of the growth in trading volume were BlackRock's IBIT funds with a market share of about 50%, as well as Fidelity's FBTC, which occupies a BTC-ETF market share of about 17%.

The second-largest fund, Grayscale's GBTC, has been gradually reducing trading volumes. The Block cites high commissions and the outflow of investor funds as reasons negatively affecting the results of GBTC. Since January, GBTC's share of total trading volume has fallen from 51% to 23.5% as of April 9.

Net outflow of bitcoins from the Grayscale GBTC ETF storage address for the day on April 9 made up about 2245 BTC. At the same time, the main influx of liquidity into the Bitcoin ETF came from BlackRock’s iShares fund, which received an influx of 1,865 BTC. Currently, 11 spot Bitcoin ETFs hold a total of 839,112 BTC on their balance sheets, worth approximately $57.89 billion.

Earlier, Chinese media reported that two local financial giants, Harvest Fund and Southern Fund, intend to offer shares of their own future Bitcoin spot exchange-traded funds to clients through their Hong Kong branches.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.