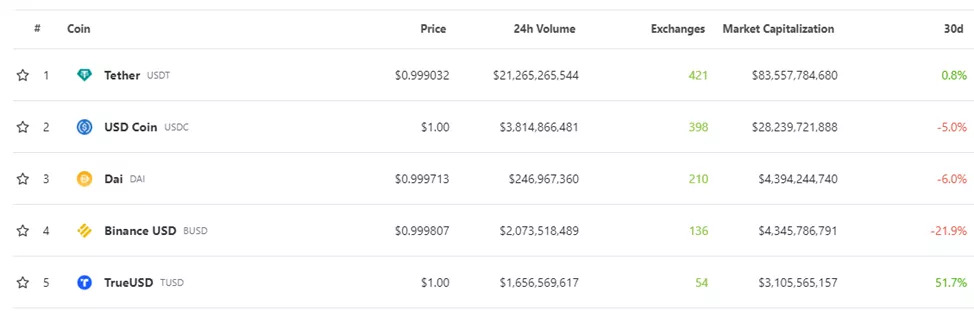

The capitalization of Binance USD (BUSD) decreased to $4.35 billion. In the rating of “stable coins”, the asset lost to DAI ($4.39 billion) in third position.

After reaching a peak of $23.36 billion in November 2022, BUSD capitalization has fallen by 81.4%.

The reversal coincided with the collapse of FTX. The negative trend in February 2023 was strengthened by the order to stop issuing a stablecoin, aimed at NYDFS partner company of the Paxos exchange. The firm has stopped issuing new coins and will continue to support redemption and conversion operations until at least February 2024.

The negative dynamics of BUSD capitalization continued amid pressure SEC on Binance. On June 5, the regulator filed 13 charges, including the sale of unregistered securities.

Later, the department demanded an emergency freeze of Binance.US assets from the court. The American branch announced the suspension of deposits in dollars from June 13th.

Market depth for the top 25 crypto assets on Binance.US has decreased by 78% since the filing of the lawsuit, according to Kaiko. Experts said that many large market makers left the platform, including Wintermute and Keyrock.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.