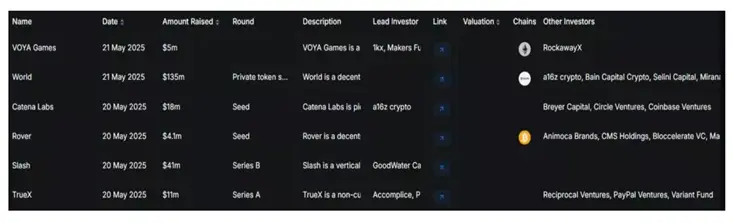

According to experts, over a week, crypto projects attracted more than $ 214 million, and there is a tendency to increase funding.

Venture funds also have significant volumes of retained funds. For example, A16z Crypto in 2022 formed its fourth fund in size of $ 4.5 billion. The total amount of assets under the management of the company reached $ 7.6 billion, and most of these funds remains non -investigated, experts say.

Additional factors that stimulate the influx of capital on the market were the softening of the US FRS monetary policy and the support of the cryptosector by the administration of Donald Trump.

According to analysts, by the end of the year, the volume of venture financing in the industry can amount to $ 18 billion – twice as high as the average annual indicators of the previous two years.

Earlier, HTX Research analysts reported that as the Bitcoin price rises, the capital of investment funds is gradually redistributed to promising altcoins.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.